Sublime

An inspiration engine for ideas

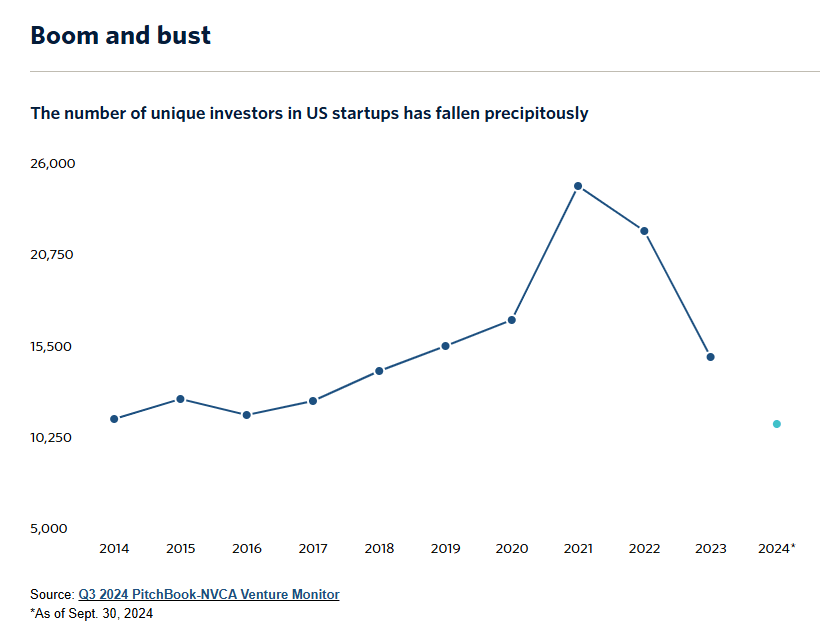

Over the past five years, the largest venture firms have played a lead role in the repeated boom-and-bust cycles of tech.

Each time, these giants stoke the fires and use the heat to ratchet-up their AUM. Each time, it has been small ("more volatile") firms that paid the price on the way down.... See more

If anyone knows about having a lot on the line, it’s Jordan Walters of the Silicon Valley branch of the investment house Smith Barney. Jordan is exactly the kind of person you’d look for in a financial planner: he’s calm, he’s thoughtful, and he always takes the time to listen. As we sat down in his office and sipped from the minibar-sized can of

... See moreOri Brafman • Sway: The Irresistible Pull of Irrational Behavior

John: I was thinking about how 'AUM-weighted slop' isn't an excuse for slop.

If you put 1% of your fund into startups that are like "We're the craziest and most degenerate companies," if that 1% gets 1000x more views than the other 99%, you'll be known as the slop fund. https://t.co/7gcR3eh4SL

TBPNx.com

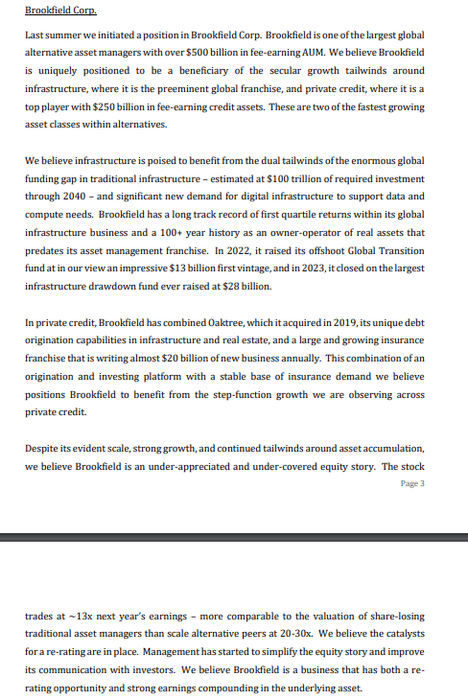

Daniel Loeb of Third Point on $BN

"We believe Brookfield is a business that has both a rerating opportunity and strong earnings compounding in the underlying asset." https://t.co/nYTtQEN3D5

Stanley Druckenmiller is one of the most successful hedge fund managers in history, known for his sharp macroeconomic insights and unparalleled risk management.

As George Soros’ right-hand man at Quantum Fund, he famously helped “break the Bank of England” in 1992, shorting the British pound and earning $1 billion in a... See more

investmentbankingbibleinstagram.com

9. El conocido financiero @Ritholtz sobre cómo NO invertir https://t.co/C5I99dyvks