Sublime

An inspiration engine for ideas

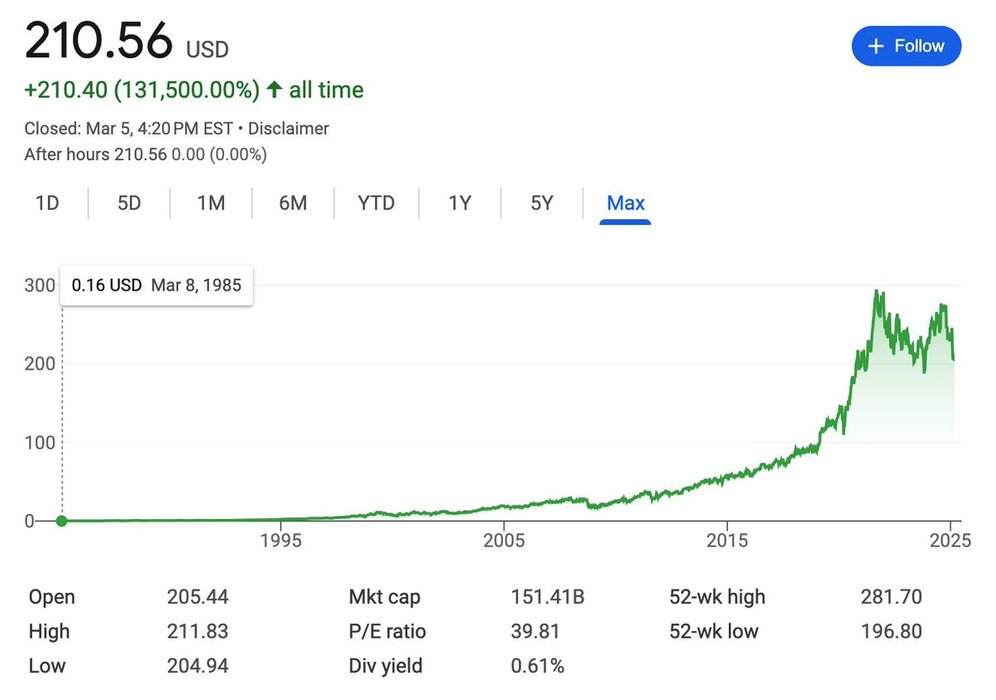

Solving "boring" problems can be lucrative in life science. Danaher is a conglomerate that makes your centrifuges, antibodies, microscopes, etc. Within ~1/2x $AAPL return since '85...without making a drug. "Hard" to replicate but underrated in all the high-flying tech talk. https://t.co/2zVGmHeFkf

My conversation with John Zito, co-president at Apollo, on how they are building one of the most interesting businesses in finance and investing.

We cover all aspects of markets and investing. John is one of the smartest, funniest, and most creative people I’ve met in this business. Enjoy!

T... See more

Patrick OShaughnessyx.comIn it’s heyday, Goldman’s special situations group was the navy SEALs of money making. Today’s guest, Alan Waxman, used to run that group before leaving to build Sixth Street, now a $115b behemoth.

SSG heads were sometimes of the more brainy, nerdy variety. Not Waxman. He is a force of nature and energy who apparently w... See more

Patrick OShaughnessyx.com

napoleon bonaparte’s heir runs a search fund to buy small cap services business https://t.co/NGMTYppewu

After 25 years of solitude, the most influential tech billionaire you've never heard of broke his silence to talk to @JeremySternLA about what he calls “the single best product I’ve ever built, in four decades, by far.”

Colossus can report for the first time that Trilogy founder Joe Liemandt is the product guy behind Al... See more

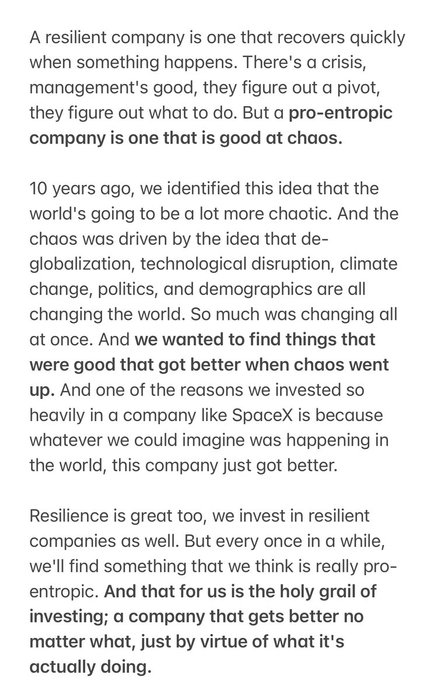

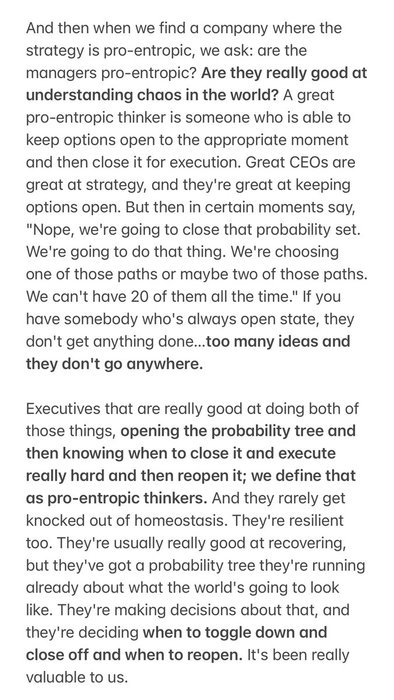

Antonio Gracias on investing in companies that benefit from choas https://t.co/LbAjX3DMbt

I am often asked for stock recommendations, but generally don’t share individual names unless I believe the risk versus the reward is extraordinarily compelling.

As we look toward 2025, one investment in our portfolio stands out for large asymmetric upside versus downside so I thought I would share it.

_... See more

Bill Ackmanx.com

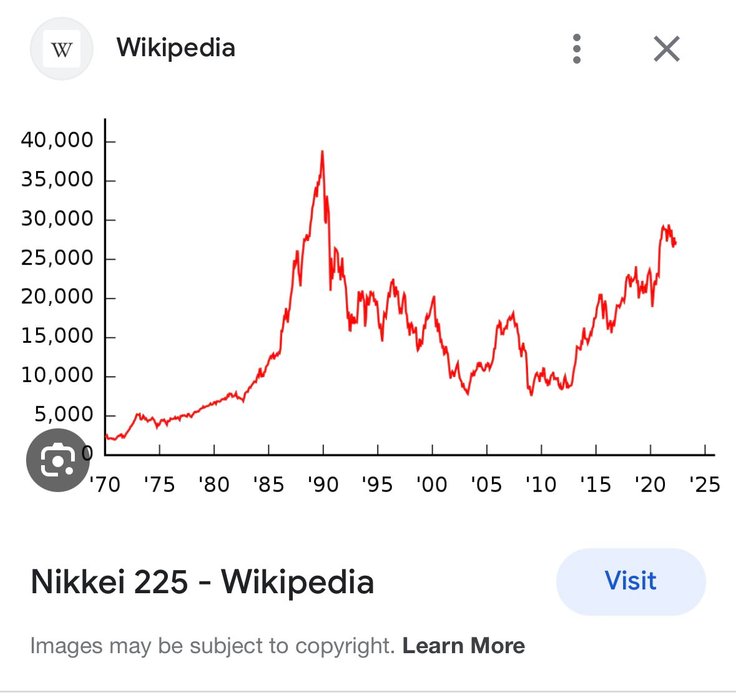

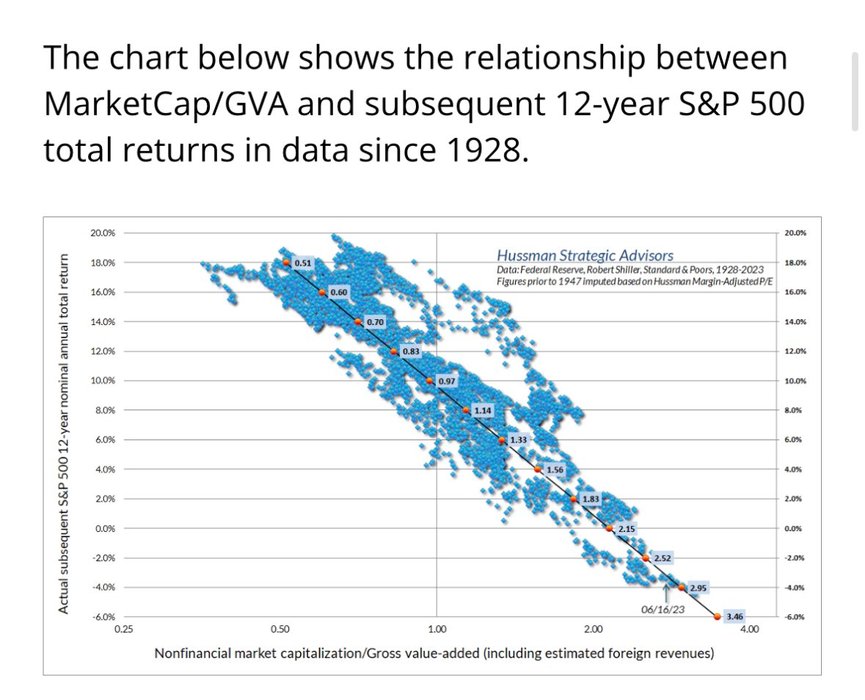

One of the greatest mistakes I see smart people making is assuming that the S&P 500 will yield 8% “because it always has”.

I would to introduce them to Japan’s Nikkei 225. If you bought the index in 1988 (!!!) your return would be negative 25 years later.

Turns out valuation matters. 👇🏻... See more

GLP1s have added $1T in market cap to Eli and Novo over the last 5 years. That's 3x+ the market cap created by all biopharma startups over the last 30 years combined. This is a bit of an indicment of the biotech startup ecosystem. There are many $1T and even $10T drugs to be invented, we just don't fund them. Through no one persons fault, the biote... See more

Blake Byersx.com