Sublime

An inspiration engine for ideas

Embracing Paradox

Exploring the balance between opposing principles in investment, such as trust versus skepticism, patience versus urgency, and transparency versus confidentiality, emphasizing the importance of harmony in decision-making.

static1.squarespace.comHe is both well liked and very intelligent. He is also very rich. I consider his annual “Chairman’s Letter” (in the Berkshire annual report) to be indispensable reading for anyone wanting to do well in business.

Rabbi Daniel Lapin • Thou Shall Prosper: Ten Commandments for Making Money

The Global Expatriate's Guide to Investing: From Millionaire Teacher to Millionaire Expat

amazon.com

This is Bill Perkins.

He made $100,000,000 in a single year, trading oil and natural gas.

He’s a hedge fund manager, high-stakes poker player, and author of one of my favorite books Die With Zero.

Here’s Bill’s story: https://t.co/7CwmK6uQyK

Cliché Munger Quote: “I read Barron's for 50 years. In 50 years I found one investment opportunity in Barron's out of which I made about $80 million with almost no risk.”

I don’t know if all of these are <1k but they all put out incredible work, whether that’s through skill in reading the market or just having unique... See more

Citrinix.com

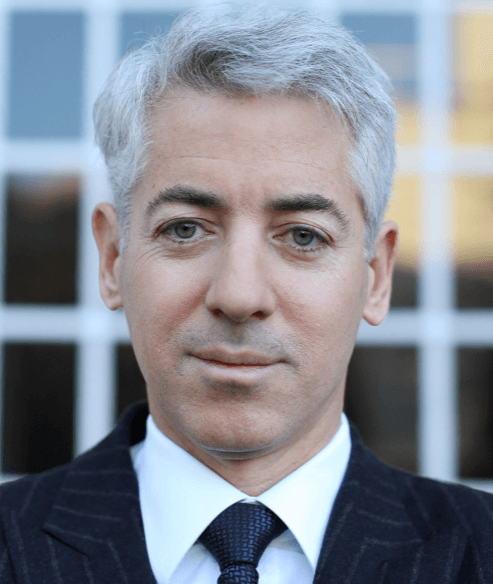

Bill Ackman Manages Over $8.7 Billion in Assets

Achieved 373% accumulative return 2004-2010.

A 58% return in 2019!

He makes all of his Analysts read these 11 books:

📚 https://t.co/XomKpXdDVI