Sublime

An inspiration engine for ideas

Embracing Paradox

Exploring the balance between opposing principles in investment, such as trust versus skepticism, patience versus urgency, and transparency versus confidentiality, emphasizing the importance of harmony in decision-making.

static1.squarespace.com

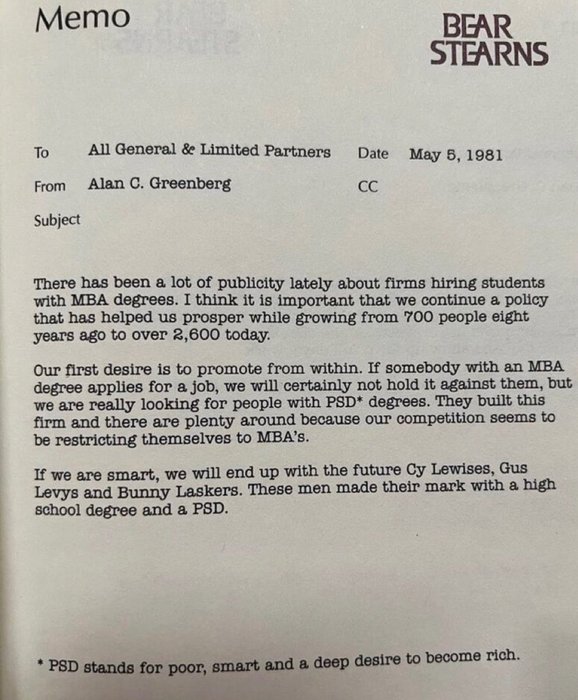

1981 memo on hiring from Bear Sterns

Sought ppl with a degree in PSD - poor, smart and a deep desire to get rich

Warns agst MBAs

Co died 37 years later

Prob started hiring MBAs https://t.co/uUhFgac9Yp

Scientists Tracked 1,000 Kids for 40 Years. This Was the №1 Predictor of Financial Success

Jessica Stillmanentrylevelrebel.medium.com

relationship of earnings and stock prices—the correlation’s very low.

W. Brian Arthur • Complexity Economics: Proceedings of the Santa Fe Institute's 2019 Fall Symposium

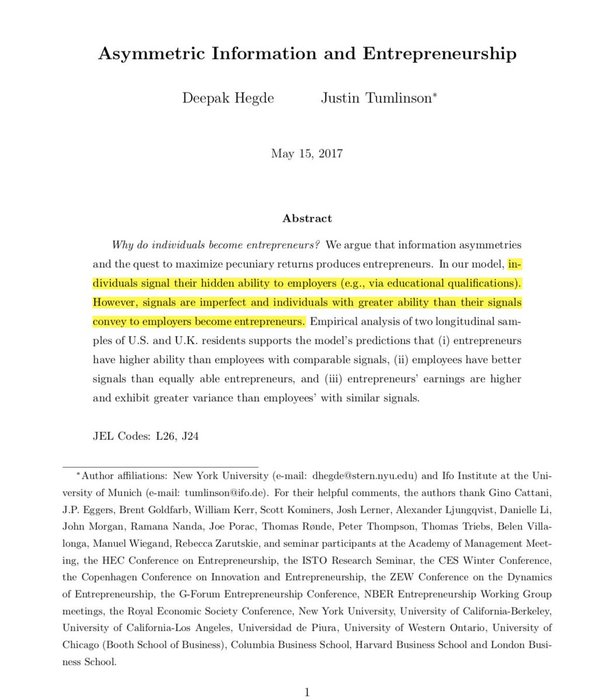

4/ This paper by NYU Stern (MBA school) friend + prof Deepak Hedge suggests...

Individuals with ACTUAL ability that EXCEEDS the SIGNAL value of their ability (ie they know they are better than employers can tell from credentials)...become entrepreneurs. https://t.co/x9AAD9BMFN

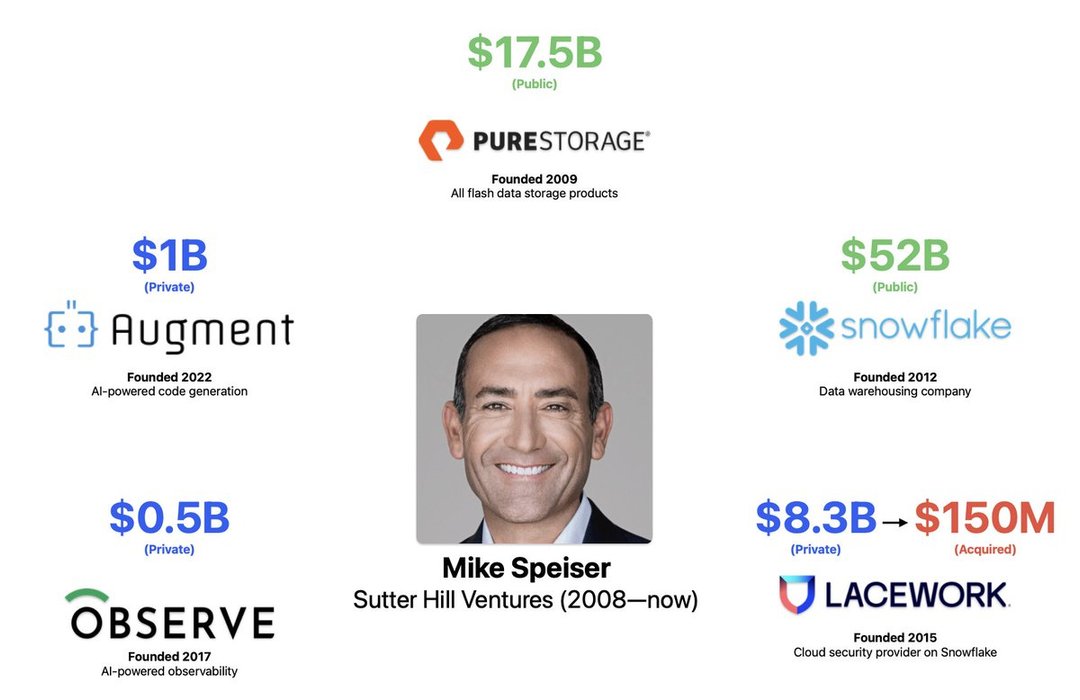

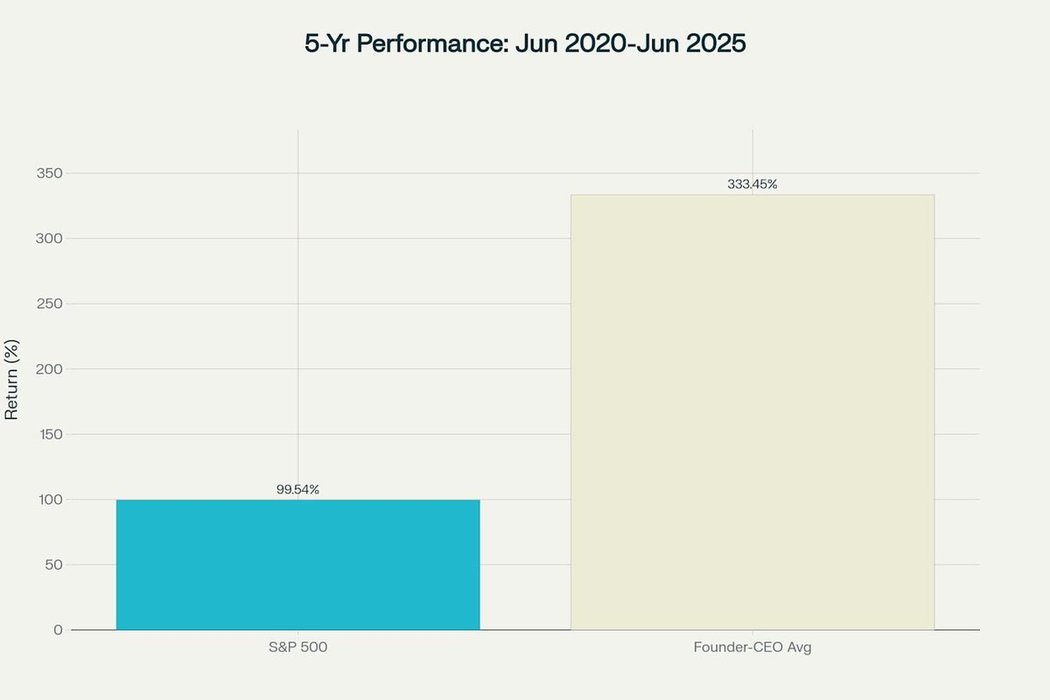

I'd like to invest in an index of founder-led companies

Perplexity Labs prompt: identify companies currently in the S&P 500 where the CEO is the company's founder. Then, plot the avg % change in stock price for the founder-led companies over the past 5 years vs. the S&P 500 https://t.co/DI88YmOzH5