Sublime

An inspiration engine for ideas

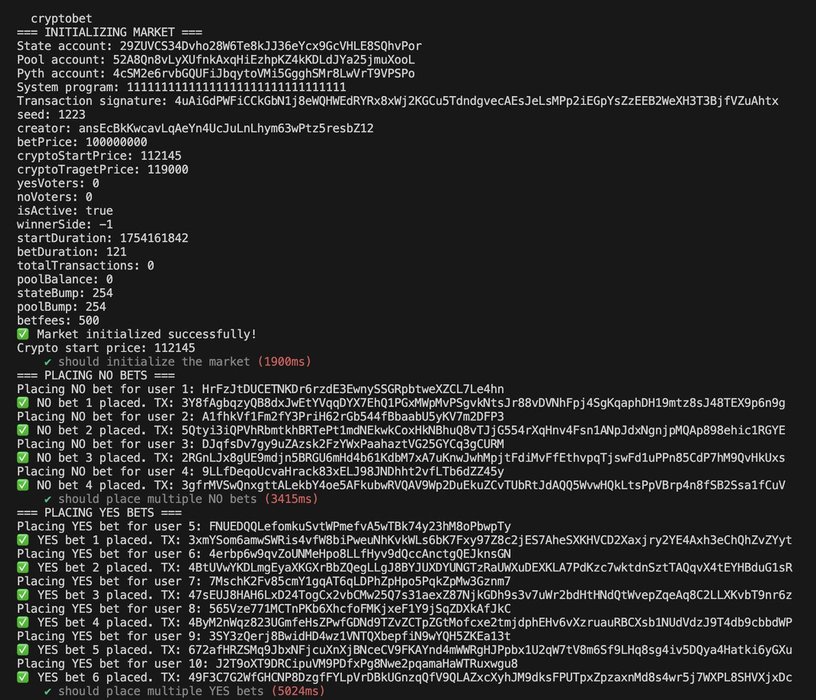

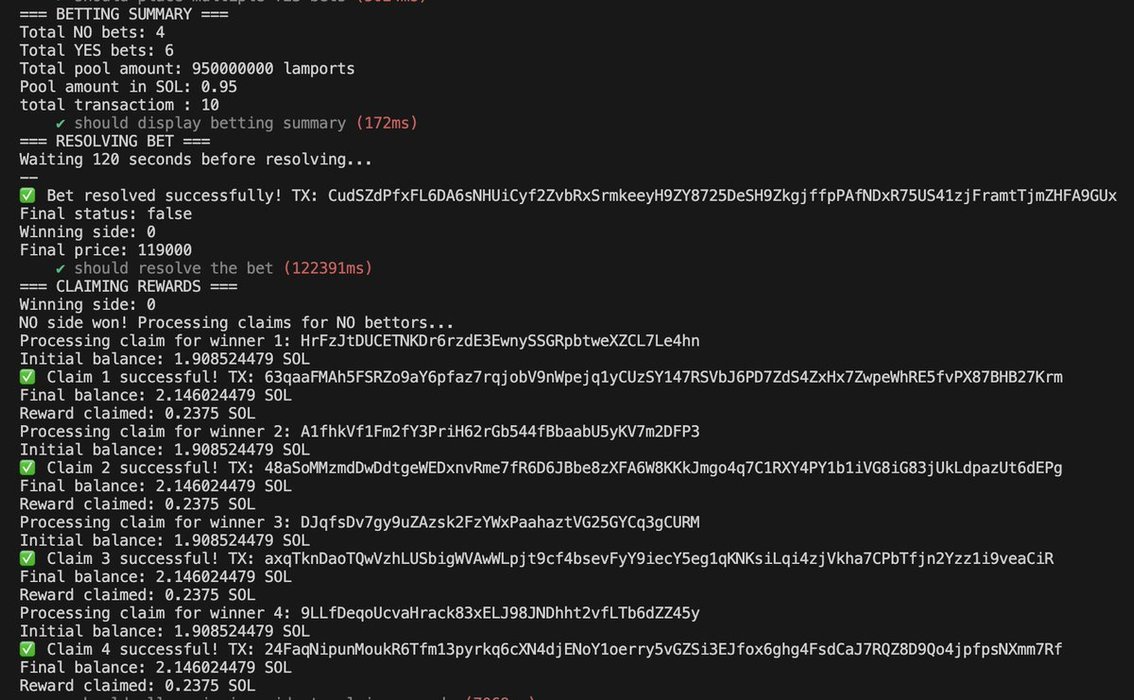

Just wrapped up CryptoBet – a decentralized betting protocol on Solana!

- Built with Anchor, uses Pyth for price feeds, and settles everything on-chain.

- Create markets, place bets, resolve, and claim all trustless!

github repo 👇 https://t.co/XYGpgQ7A1h

Introducing AlphaGeometry: an AI system that solves Olympiad geometry problems at a level approaching a human gold-medalist. 📐

It was trained solely on synthetic data and marks a breakthrough for AI in mathematical reasoning. 🧵 https://t.co/g3RFSoWNPP https://t.co/NER2TJsA7r

Google DeepMindx.comDeFi Portfolio Management

Gwindorian • 1 card

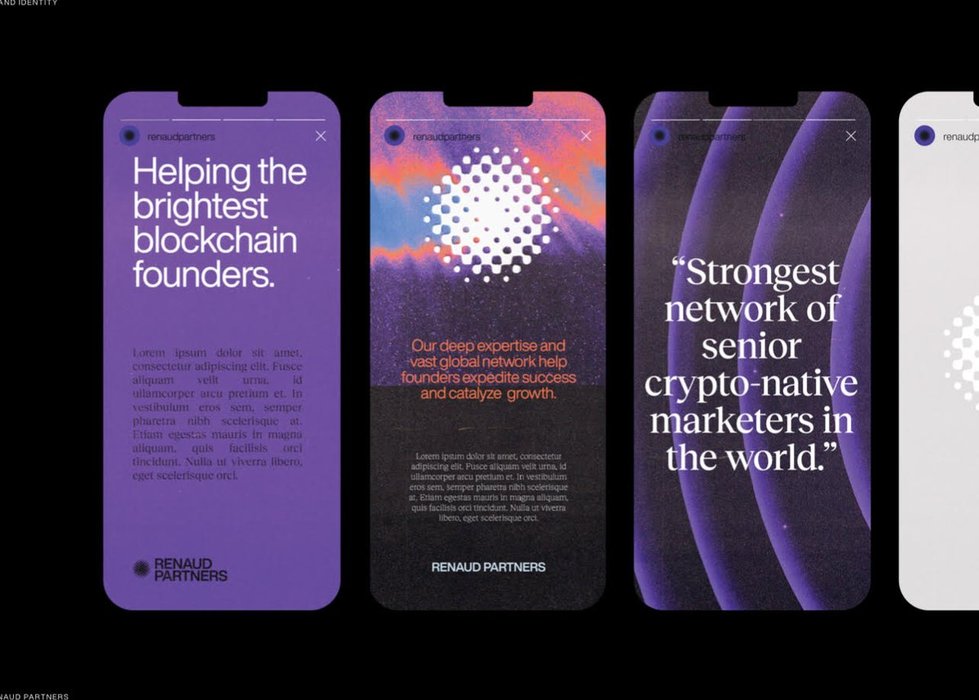

The branding for my new venture (g2m advisory firm) is looking pretty spicy imo 🌶️🤌 more soon.... https://t.co/spHjTU8qCk

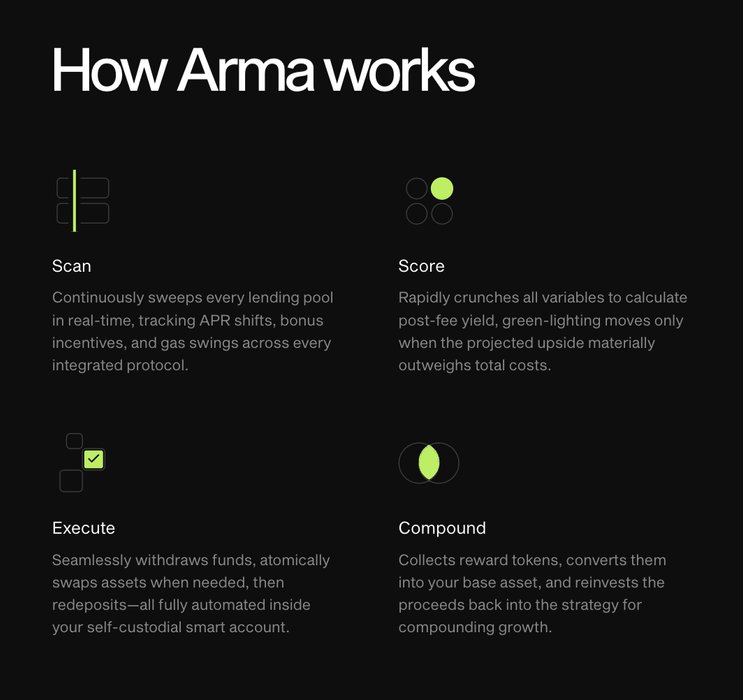

Our agents autonomously move your capital to wherever returns are highest.

Never sleeping.

Never missing opportunities.

Never letting emotions cloud judgment.

100% personalized to your capital size and risk preferences. https://t.co/bdKR2f4HMT