Sublime

An inspiration engine for ideas

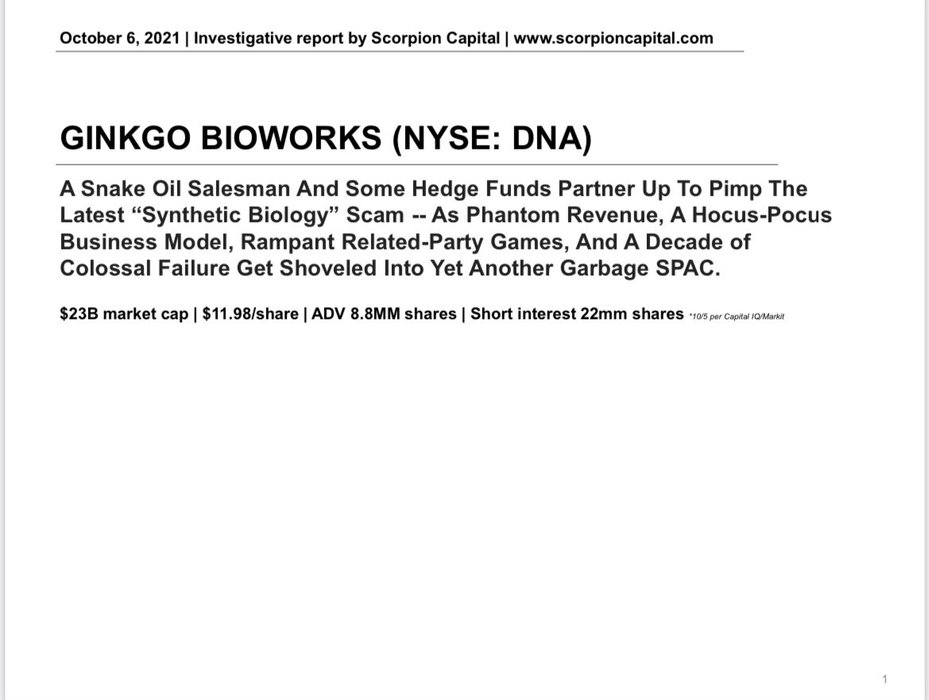

1 We are short $DNA. Ginkgo Bioworks is a colossal scam, a Frankenstein mash-up of the worst frauds of the last 20 years. At $23B market cap, it is rare to see a related-party scheme on Ginkgo’s scale in the US markets – it is, quite simply, the US version of the “China Hustle.” https://t.co/B6Psue4jAt

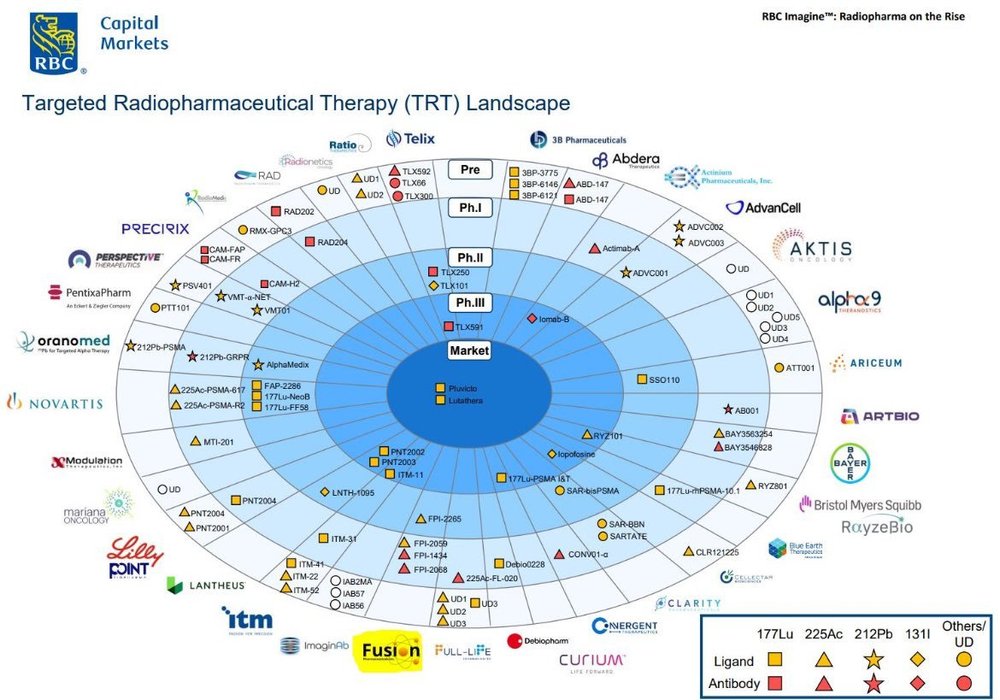

Great infographic of the targeted radiopharmaceutical landscape from @RBC

$CLRB & $ATNM are my favorite small-cap buyout candidates,

They aren't backed by biospecialists but both are dirt cheap and should have marketed products by next yr plus a solid pipeline that should interest Big Phar... See more

LBI and others reference the importance of having "specialist" investors in a stock and how that correlates with performance and likely acquisition.

But who are these investors? Helpful list with #AUM from @Stifel

#learnbiotechinvesting #biotech #investing #BiotechPrometheus https://t.co/2EGD6KIBQr

5 | “Fears about biotech funding and the sell-off in the broader life sciences area created an opportunity for us to invest in IQVIA. It is a leading provider of clinical trials and health care technology and analytics formed through the merger of Quintiles and IMS Health in ‘16.”

$IQV

15/19

Hidden Value Gemsx.com$MRK CEO again says DEALS on the way, Keytruda LOE too big!

Hints at Oncology...

Who are they buying? https://t.co/9e8EwscJsA

DoctorDueDiligencex.com

There’s a fund manager out there I have been following for a few years who consistently nails biotech buyouts. Here are his new buys https://t.co/oLwSS0am8Y

GLP1s have added $1T in market cap to Eli and Novo over the last 5 years. That's 3x+ the market cap created by all biopharma startups over the last 30 years combined. This is a bit of an indicment of the biotech startup ecosystem. There are many $1T and even $10T drugs to be invented, we just don't fund them. Through no one persons fault, the biote... See more

Blake Byersx.com

The team that invented protein LLMs has $26M more to continue advancing state of the art, and partnerships with AstraZeneca, Bristol Myers Squibb, and Takeda worth $550M+ in upfront and milestone payments + royalties. @fiftyyears led the pre-seed and supported every round since. https://t.co/5N58ffWzVx