Sublime

An inspiration engine for ideas

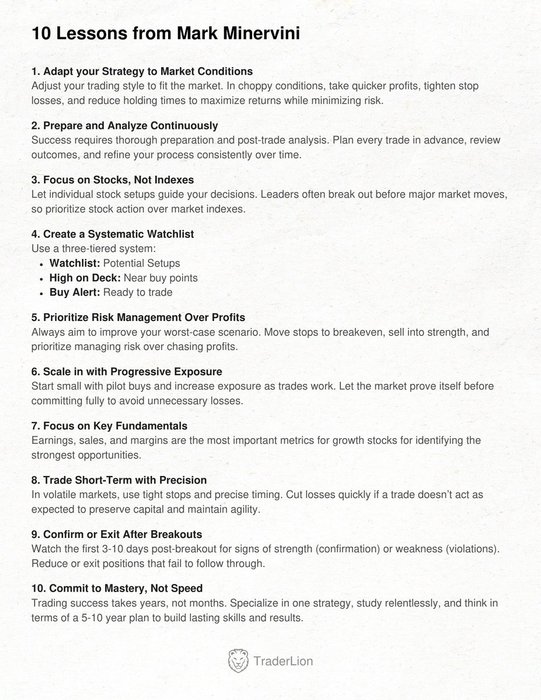

How does Mark Minervini succeed in volatile markets?

Here’s his winning formula: https://t.co/TaROpcuWJe

Rule #1, Payback Time, and The Education of a Value Investor;

Danielle Town • Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffet, Charlie Munger, and My Dad)

Any service that systematically updates stocks can help. I'd go through new editions of Value Line every week. I don't read, much less follow, the valuations or predictions. I studied the numbers.

John Neff • John Neff on Investing

How to Make Money in Stocks: A Winning System in Good Times and Bad, Fourth Edition

amazon.com