Sublime

An inspiration engine for ideas

You could make $150,000/year and pay $0 in taxes.

This is because the tax code is built for investors, not W-2 employees.

Let me explain how it works (and how you could live tax-free):

The Money Cruncher, CPAx.com🚨 Startup founders: 1099 Filing Deadline is January 31 - need help?

Here's what you need to know (from a former accountant turned CEO @tryfondo 👋): https://t.co/2tflNhUZ99

David J Phillipsx.comTAX DAY.

Got the email from my CPA Friday. I will be getting a refund again. This year my effective tax rate will be about ~9% on a high 6-fig income.

How? I'm glad you asked...👇

Kriss Berg, etc.x.comBackdoor Roth is the greatest loophole for high income earners.

I'm giving away a 30-page guide showing exactly how to do it, report on your taxes and file Form 8606

• Like and bookmark

• Comment "Backdoor"

& I'll DM... See more

The Money Cruncher, CPAx.comOne of the most remarkable loopholes in the US tax code:

If a married couple earns $240K+, they cannot contribute directly to a Roth IRA

But, they can instead use their 401k to get $100K+ into their Roth IRA every single year

Here's how the "mega backdoor Roth"... See more

Ankur Nagpalx.comSomebody might owe you some money 👀 @ecommjess has been waiting for more info on this payout for a long time! Are you getting any money back?

.

.

.

#taxes #return #moneytips #free #savemoney #personalfinance #file #software #lifehacks #news #taxreturn #spring #shopping #taxseason #usa

ecommjessinstagram.com

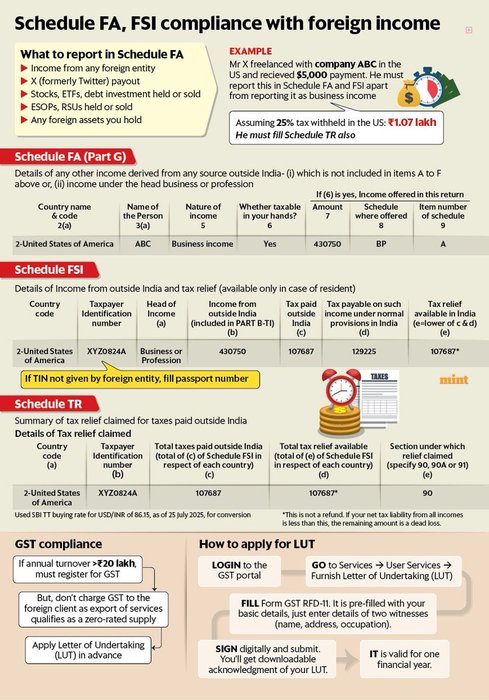

Today @Shiprasorout gives you the forms to fill if you have foreign assets or income, in your ITR. Applies to freelancers too if you have clients abroad. Even if they pay money to you in your Indian account.

https://t.co/rLvmuhi7Zz https://t.co/sTqQ9A7KTs