Sublime

An inspiration engine for ideas

Godzilla Returns

In a desperate bid to save their falling currency, the Japanese have begun hiking rates. USDJPY has begun collapsing, and with it, the carry trade that held up their massive overleveraged economy.

A THREAD 🧵🔥👇

ゴールドはいよいよバブル終焉の気配🤔

ダブルトップつけてこれだけの勢いで急落してしまうと、少し戻っても高値で掴んでしまった人の撤退売りが山ほど降ってくるの、それを消化できるほどの買いエネルギーが世界にあるかどうか。自分のルールに従って買わなかったけど、やっぱりルールは大事ですね✊ https://t.co/IRk37Q9dyy

The sharp rise in the JPY/USD is causing a massive unwind of Yen carry trade positions and contributing to the sharp decline in US stocks. For those who do not understand how this works, a brief explanation

1) Many traders were borrowing Jap Yen (JPY) at low interest rates, converted them to USD and used this to buy US... See more

I have found my hero.

(Source: Why the Japanese Yen Is So Volatile - Bloomberg Originals) https://t.co/6VOXqphvAl

Goshawk Tradesx.com

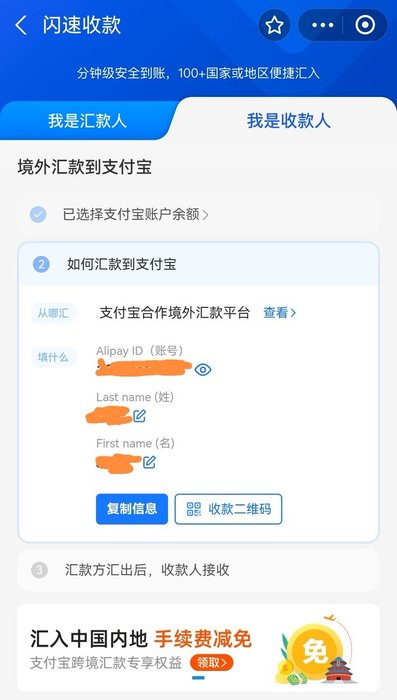

狗总币圈100%防冻安全出金大法番外篇:资金回国到支付宝新法

看过狗总置顶教程的都知道,你的u通过Kraken等交易所出金外币后:

1. 出金到港卡,资金回国可以国内ATM提现,或者绑定支付宝/微信消费,

2.... See more

"Japan is the most liquid and easy-to-short market in this time zone," said Zuhair Khan, a senior fund manager at UBP Investments in Tokyo. "When you have global macro investors who take a negative view about Asia, then [Japan] is the market you use."