Sublime

An inspiration engine for ideas

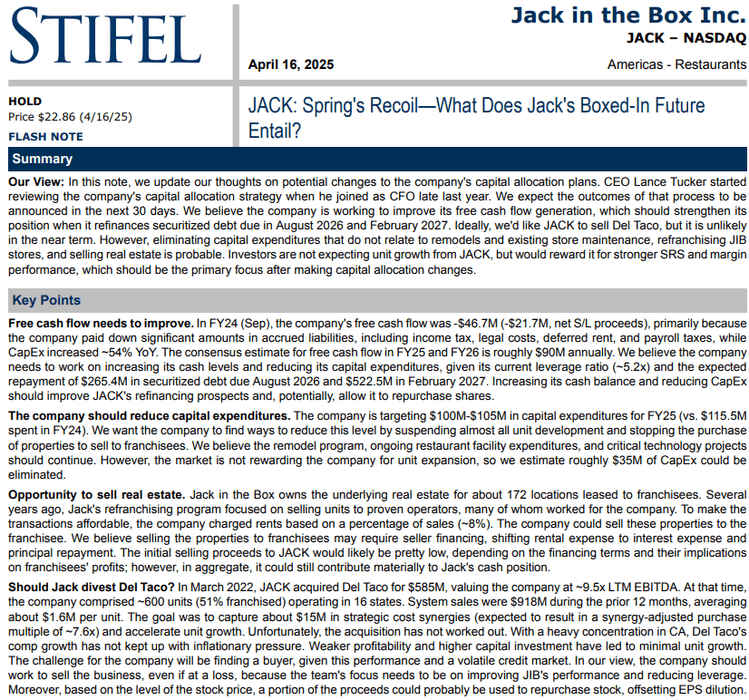

This sell-side analyst can see into the future. Stifel analyst wrote a note last week that predicted with remarkable accuracy every move $JACK announced today.

Either it's a Reg FD violation or we have an early favorite for Institutional Investor’s All-America Research Team... https://t.co/L2Jsis2Jlr

1、暴涨行情下,如何最大程度把盈利留下来?答:移动跟踪止盈

2、暴涨行情潜在风险

①此次政策转向目的是为了托底经济,避免经济金融负向循环,随着政策逐渐落地,市场会从狂热逐渐过渡到冷静(过山车行情)

②美国经济数据超预期强劲,降息预期降温美元走强,会导致部分资金撤出,缩窄国内政策空间 https://t.co/beCMlozeQE

说的好👍,这种做法就和当年许家印买了地质押贷出款,再买地(抄高地皮)再质押贷款的做法无二

没想到这种拉盘手法,如今也被国家队采用了,它只能被用于短期救盘,因为最终是需要有人接盘的,而业绩实实在在摆在那里,一旦脱离了基本面没人接盘,指数就必然回落

Ripple(66%)x.com

Final home version interface for an investing and trading journal https://t.co/U5m9YQm0i5

Scoop: Top money managers say it was Japan not China selling last night that upended the bond market and forced Trump’s hand into a pause. And yes Trump took the win as so many countries wanted to do deals. Never one thing that causes anything; story developing

Charles Gasparinox.comWithout ever tapping outside capital, Jane Street had gone from a few traders with a few million dollars, in 1999, to roughly two hundred traders working with several billion dollars, in 2014. One big reason was ETFs, whose global value had grown from less than $100 billion to $2.2 trillion (on its way to more than $10 trillion in 2022).