Sublime

An inspiration engine for ideas

At @hackeryou, rent for our 12,000 square foot space in Toronto is over $550,000 a year.

But what if I told you that at our next location, we would be able to train 480 students a year (a 50% increase) and pay about 10% as much for real estate?

Heather Paynex.com

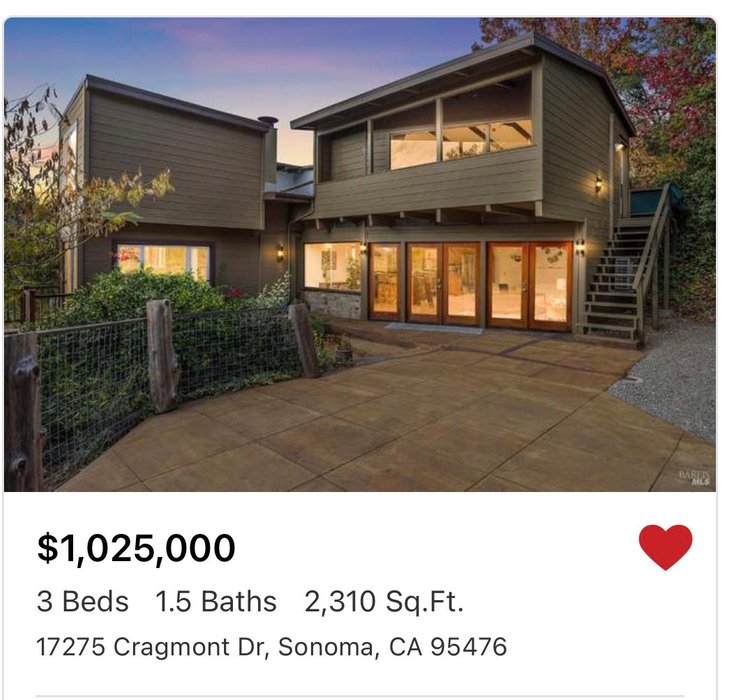

Beautiful home in Sonoma with a pool for sale.

Not zoned for short term rentals. Probably ends up being snatched up as a second home 😔

Listed for $1.025MM https://t.co/kvlSPMN4ba

Beachfront cabin for sale in Vashon, Washington

This 480 sqft home with stunning views has a boat ramp and is right on the water. Located about 1.5 hours from Seattle

On the market 4 days

Listed at $725k https://t.co/eLJ6I7JyNK

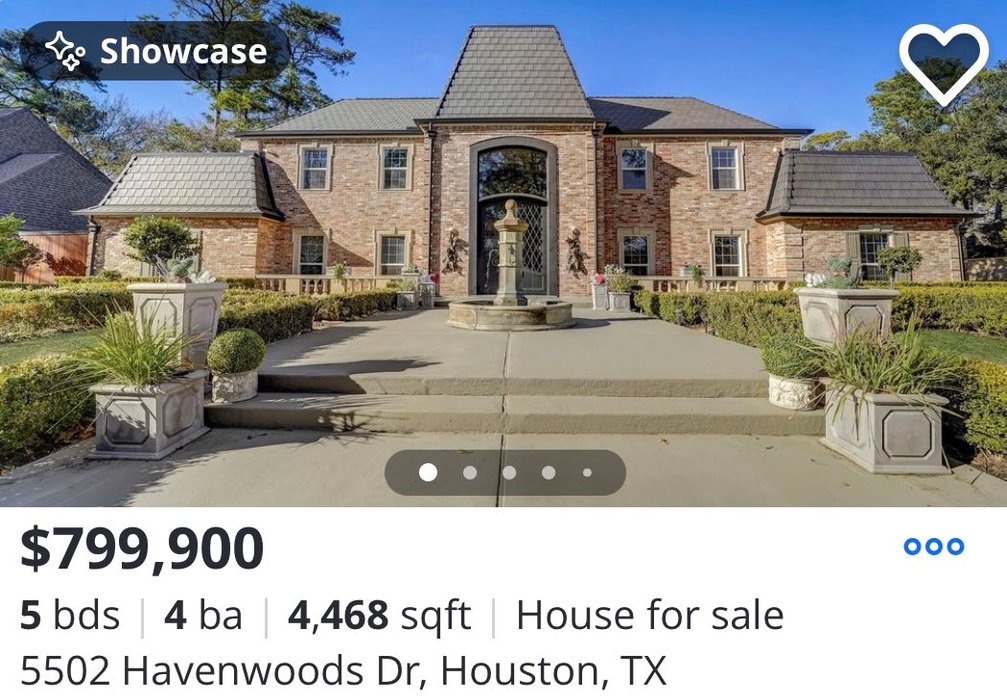

$100k price cut on this absolutely fine looking house with pool in Houston, Texas

Per listing, over $600k in improvements have been made to the home

Listed at ~$799k https://t.co/T9k959ad73

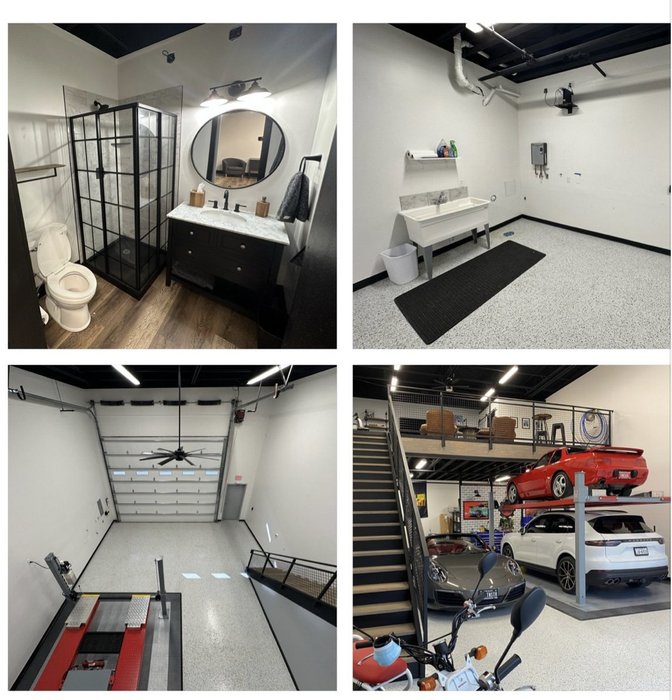

$800k luxury car garages? ($475/ft)

I drive by a place every week that sells luxury car garages. Not rents, sells. I always think "What's the play there?"

So I did some digging. I can't believe people pay $800k for fancy garages with HVAC to store a couple cars. More details:

_... See more

$HHH announces $250m of sales at Ritz Carlton Woodlands... in just 1 week...

Wealthy Americans have $$$ and want high quality housing in red states.

Stock getting killed on move in yields. I'm adding here.

Deep value for patient capital.

Capital Valorx.com

This still blows my mind.

We have upped our prices.

People are getting $2000 per month for homes.

I am getting $2000 for contractor garages with a half bathroom. https://t.co/OXnQTR788j

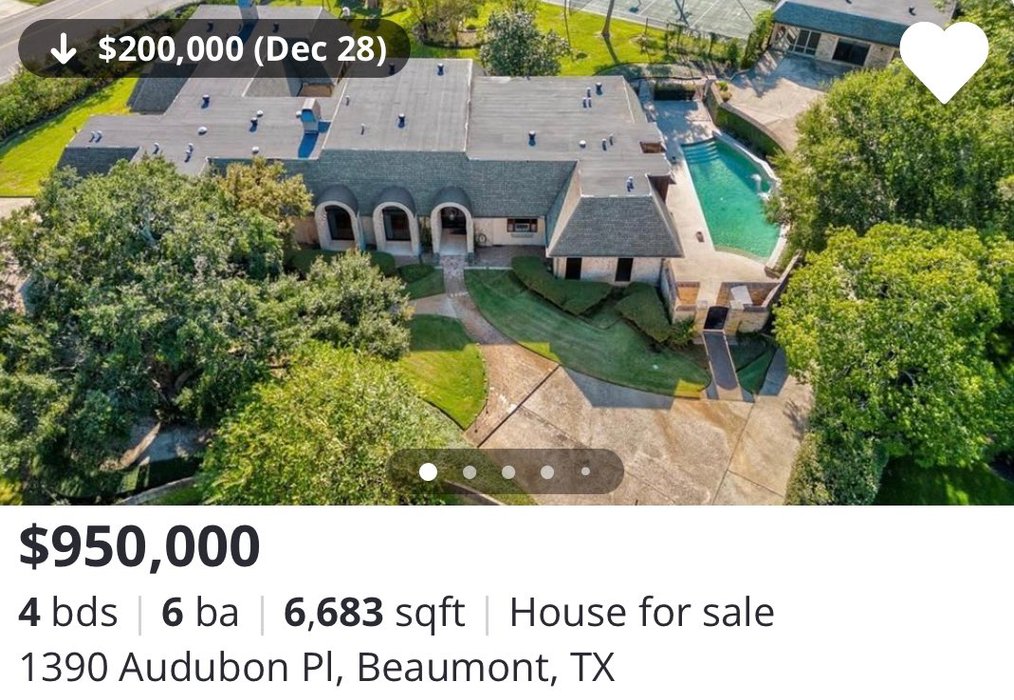

$200k price cut on this residence in Beaumont, Texas outside of Houston.

Clocking in at 6683 sq ft, the home features a pool, your own tennis court, two Sub-Zero fridges and an epic walk-in-closet.

On the market for 70 days

Listed at $950k https://t.co/VRVldfTxNN