Sublime

An inspiration engine for ideas

there are only two kinds of investment firms on earth:

1. firms underperform the market, but make LPs feel smart with beautiful letters/agms/marque deals

2. firms that outperform the market and make the LP feel stupid by explaining nothing and taking huge idiosyncratic risk.

Will Manidisx.com

🚨ELON’S $1-BILLION TESLA BET: WHY THIS ISN’T NORMAL FOR TECH CEOS

Elon just poured $1 billion of his own money into Tesla stock - right as his board is weighing a historic $1 trillion pay package.

That move isn’t just bold. It’s unprecedented in the current peak valuation market cycle. It... See more

Si hoy me la tengo que jugar, es Long Argy y nada mas. No voy a decir la de, empiezo a acumular, yo hoy voy ALL-IN AL30 de una. Y en algunas carteras con RV tmb mixeado, mas que nada $METR, $DGCU2 y $SUPV. Me encantaria poder llevar algo importante de $HAVA.

Mike Bensonx.com

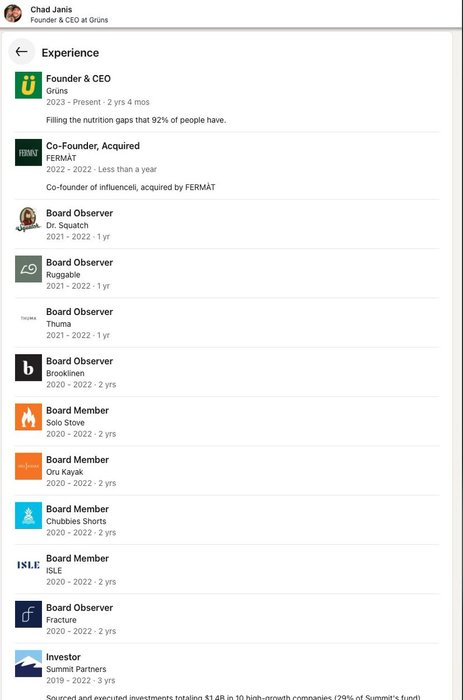

The gruns CEO's linkedin is like one of those fake shit posts people do in tech or finance-

where the guy seemingly worked for every major company on earth...

but he really lived that life.

Summit PE investor, deployed billions, to fastest growing brand in... ever? https://t.co/3Fqz9yIczk

My investment criteria: Fierce nerds who like money

stolen from the prolific @zack_hargreaves

Shaan Purix.comIn my study, I found Elad Gil to be one of the most successful angel investors. He has made investments in twenty-four billion-dollar companies—including Airbnb, Airtable, Brex, Coinbase, Gusto, Instacart, Opendoor, Pinterest, Stripe, Square, and Wish—most in the seed or series A stage. Before

Ali Tamaseb • Super Founders: What Data Reveals About Billion-Dollar Startups

This is Drake vs Kendrick for people who know what SAFE notes are: https://t.co/Uhh6r1MLgA