Investing

My Life as a Quant: Reflections on Physics and Finance. A physicist's journey from academia to Wall Street's mathematical frontier.

... See moreI came to see that creating a successful financial model is not just a battle for finding the truth, but also a battle for the hearts and minds of the people who use it. The right model and the right concept, when they

Marks memo

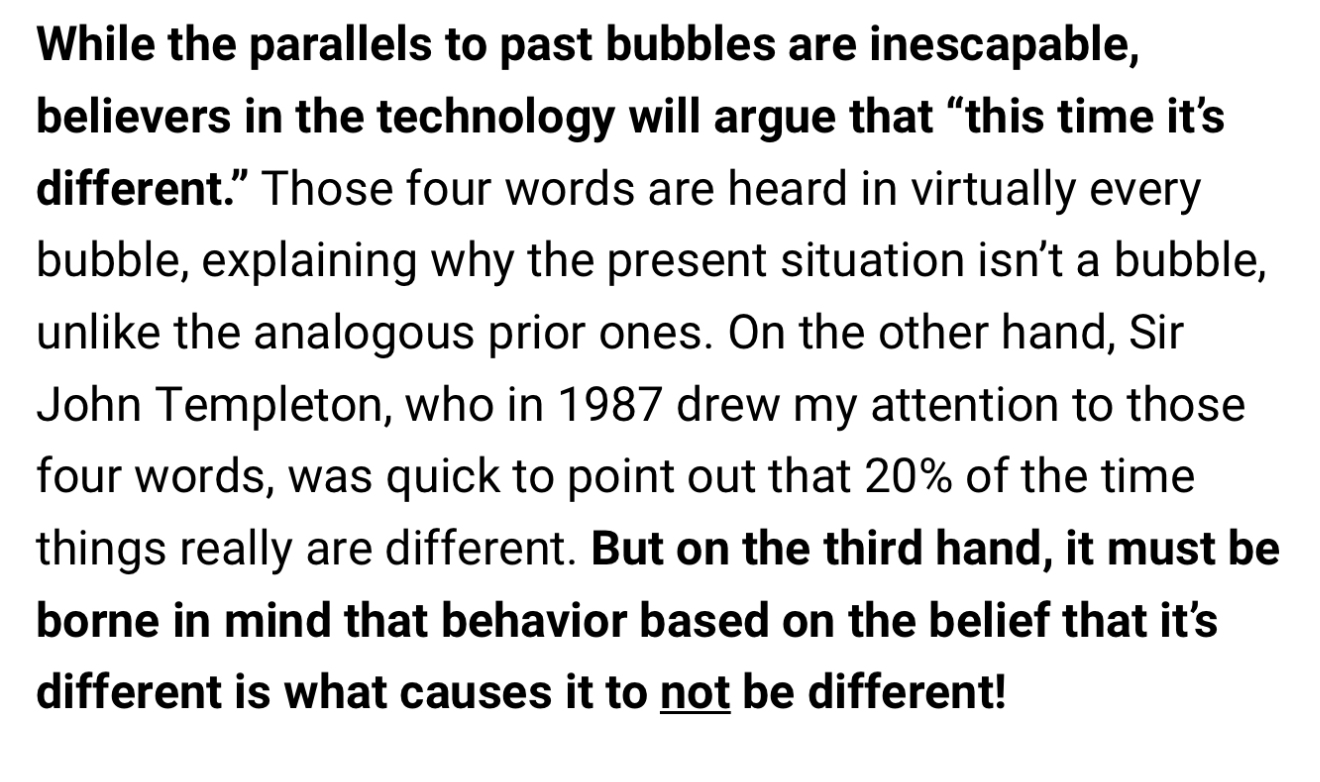

Is It a Bubble?

oaktreecapital.com

David Foster Wallace on thinking:

“Learning how to think really means learning how to exercise some control over how and what you think. It means being conscious and aware enough to choose what you pay attention to and to choose how you construct meaning from experience.”

The best type of risks to take are ones where (1) the worst outcome is manageable and (2) the best outcome is life-changing.

Think: Asking someone on a date. Or, investing an amount of money you can afford to lose into a business with high upside.

Look for opportunities where it won't kill you if it goes poorly, but you'd be blown away if it goes

... See more“Often it's the person who goes the extra mile who comes to the right conclusion. That's grit, it's perseverance, it's determination. It's making the effort. One of the things we emphasize is what do you need to do, what extra steps do you need to take to get to the right conclusion faster than those you compete with. And if you do hustle, you will

... See moreThe best opportunities go to people whose reputation got them picked before anyone else knew the opportunity even existed.

in real life things fluctuate between pretty good and not so hot, but in investors’ minds they go from flawless to hopeless.

In good times, ambiguous developments are interpreted positively, and negative ones are easily brushed aside. And when times have been good for a while, the possibility of loss recedes from consciousness. Rather, missing out