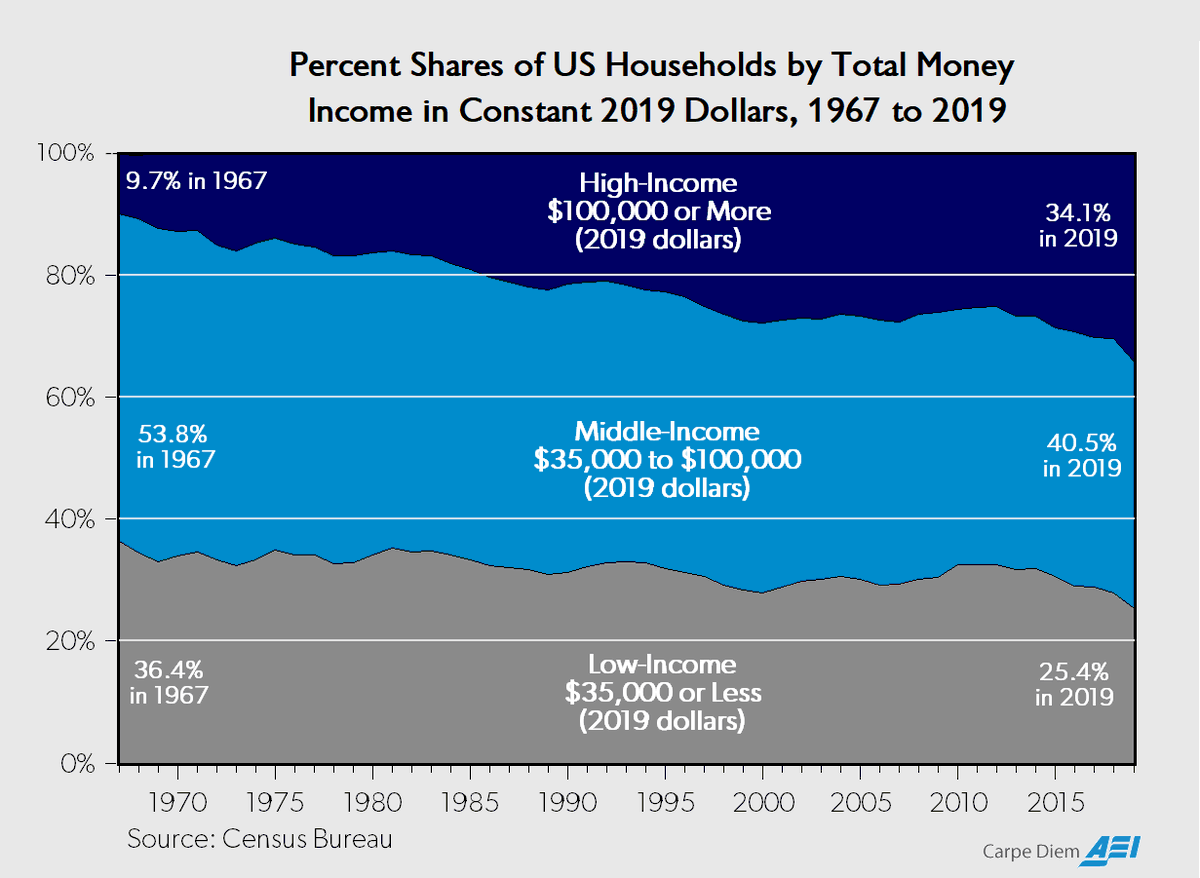

No I don't see the problem, we all got way wealthier. Percentage of total doesn't matter at all because "total" is fundamentally illiquid.

In 1970, only 9.7% of Americans were high income. Now the figure is 34.1%. That's incredible. https://t.co/sggYdoI2Tx