As I’ve been predicting, dedollarization is reaching epoch defining levels.

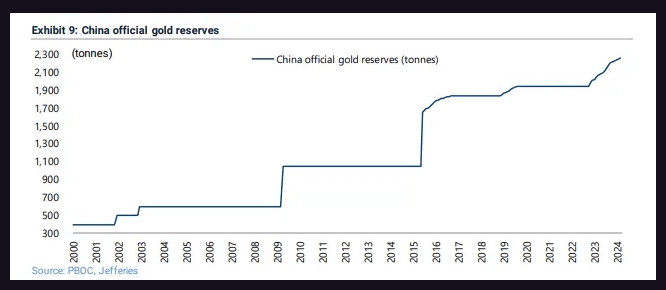

China & Russia (+ Iran) are prepping rollout of Gold backed currencies and a Gold-backed stablecoin.

This will crash the ersatz US Dollar and any hope of propping up any USD stablecoins.... See more

Max Keiserx.comAs I’ve been predicting, dedollarization is reaching epoch defining levels. China & Russia (+ Iran) are prepping rollout of Gold backed currencies and a Gold-backed stablecoin. This will crash the ersatz US Dollar and any hope of propping up any USD stablecoins. The US

There’s a reason the Chinese demanded that the IMF stop 🛑 publishing their ‘Reserve Adequacy’ calculation for China and for Hong Kong in 2019…China doesn’t have adequate USD reserves to operate their economy. Buckle up….CNY and HKD are about to get sporty. #China #CNY https://t.co/GD9debNZR1

In 60 Days EVERYTHING changes for the U.S. Dollar & it's going to be wild

In 60 days everything changes for the U.S. dollar — and no one’s talking about it.

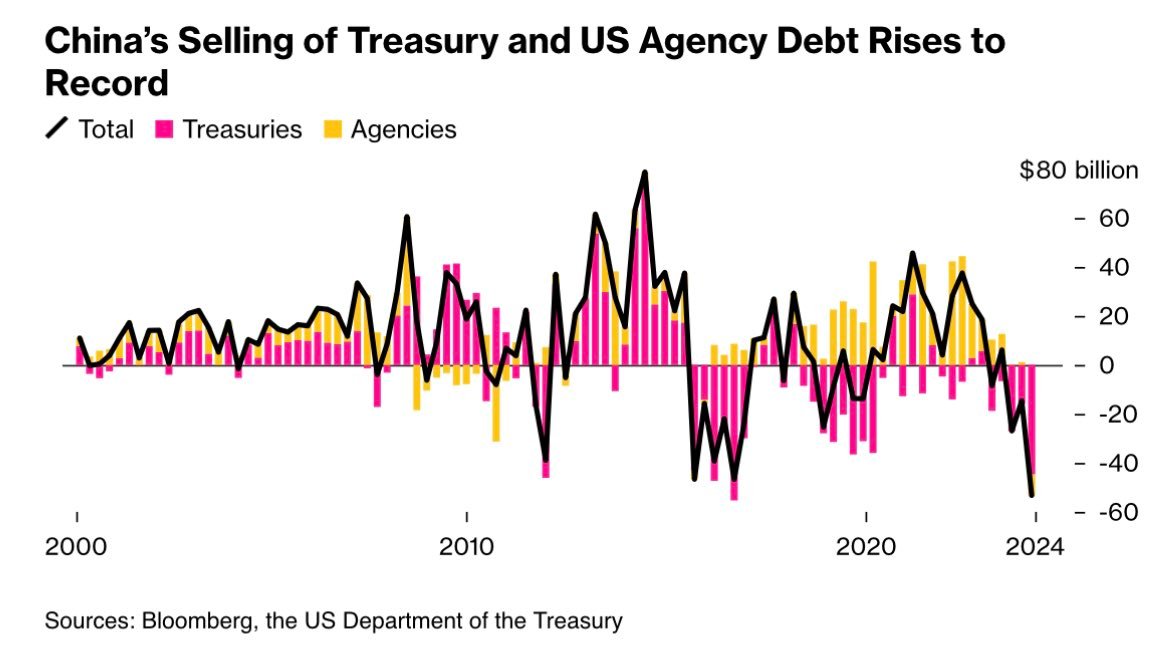

While the media obsesses over distractions, a massive financial shift is happening right under our noses. China just dumped U.S.... See more

Paul White Gold Eaglex.com

Context around the Chinese bond dump and recycling of money into gold: the Chinese and the Russians just inked a series of deals that move toward extremely tight integration of their militaries and economies. Maybe something BIG is happening…? https://t.co/Bx2bGf6qcT

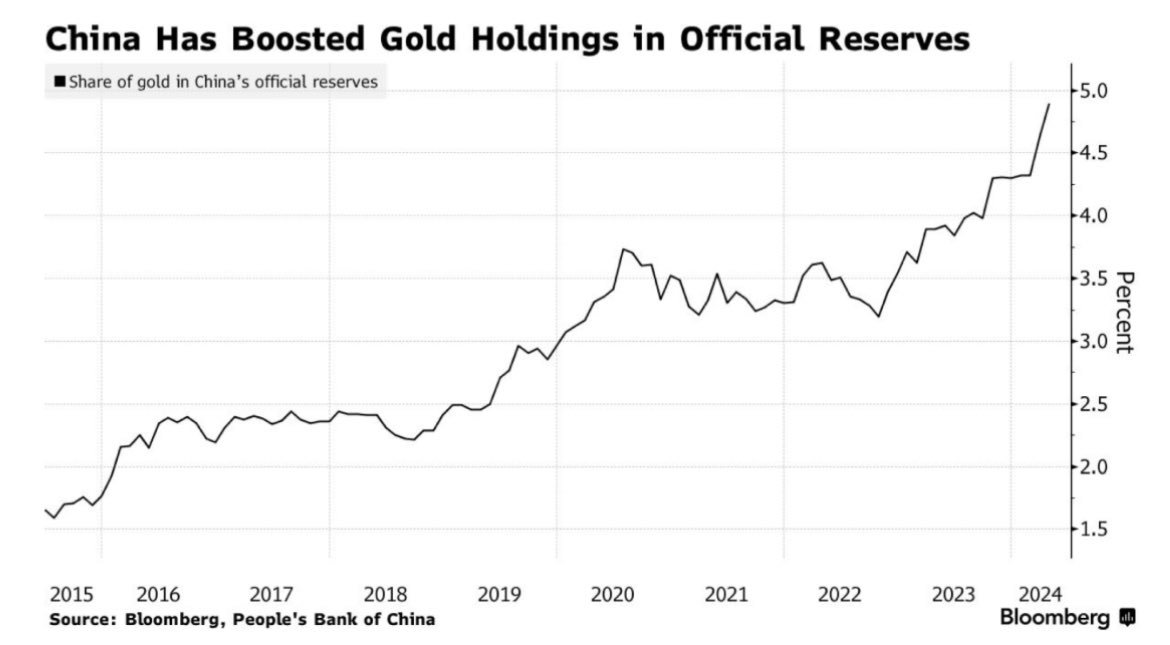

China Gold buying.

Note: Historically China buys and only announces once in a while.

Yet this past buying binge they've been updating almost religiously monthly. Why?

Stated before (as ZH contributor last year) and restating here:

China is signalling to BRICS partners it means... See more

Yellen was questioned about China suddenly dumping $859B US treasuries due to war

Few understand the US has already been preparing for this event which is why they're restricting the Dollar supply by destroying crypto exchanges, raising rates & have $2.5T in Reverse Repo waiting https://t.co/i15kQYfB06

Financelotx.com