Saved by Bryan Lord and

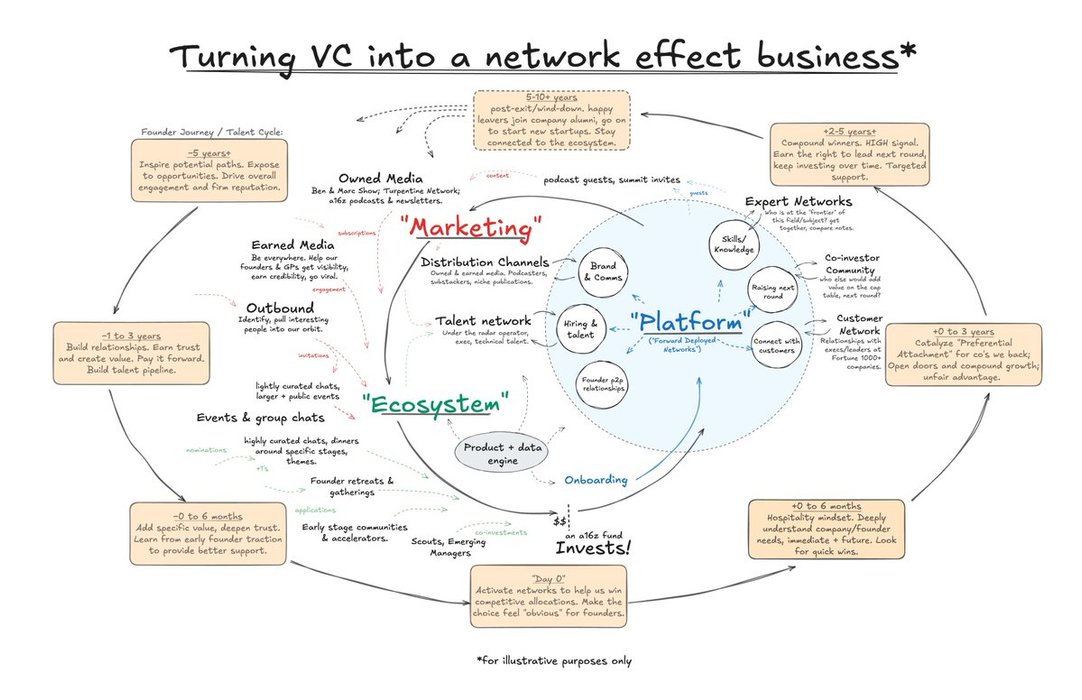

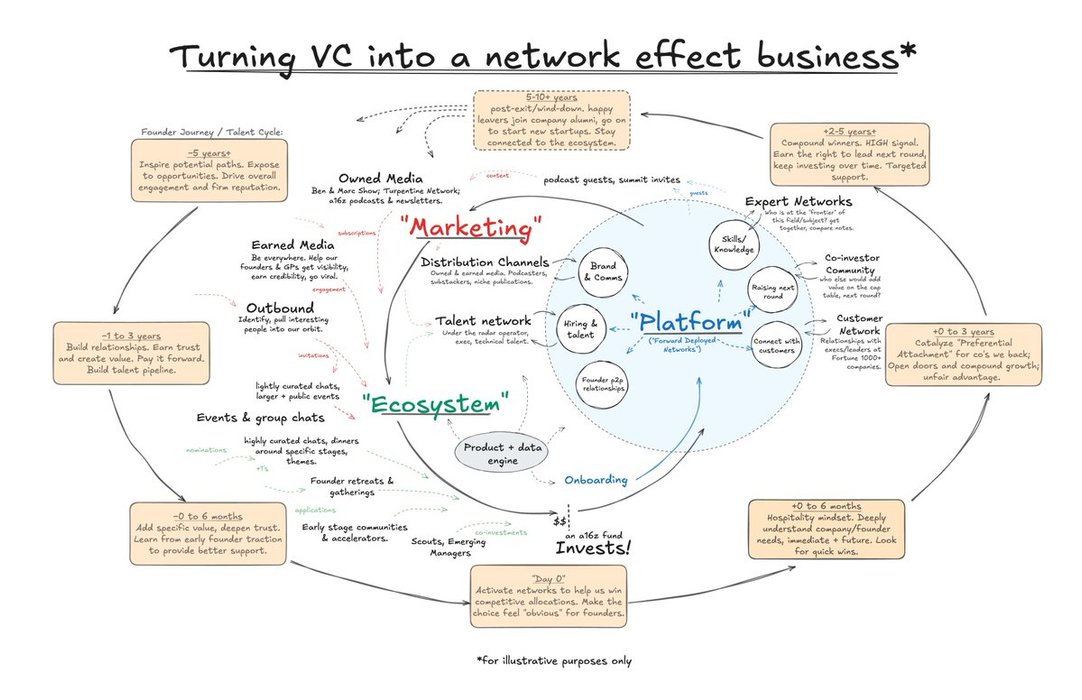

ok some personal news: 1. I'm joining @a16z! 2. my family and I are moving back to San Francisco 🇺🇸 👋 I’m joining a16z as a Partner and Head of Ecosystem. Excited to be teaming up with @eriktorenberg for a second round, continuing what has become my life’s work. I'll be focused on expanding and reinforcing the multitude of networks spanning our firm; building pipelines for emerging talent, customer networks; products and communities that help founders, operators and investors connect and build together. Feeling charged up, time to build. Some thoughts on why + what 👇 1- "Preferential Attachment" is how startups win. It starts with @pmarca, in conversation with John Collison and Charlie Songhurst on "Cheeky Pint": "…a startup needs to get into a loop where it’s accruing more and more resources as it goes… qualified executives, technical employees, future downstream financing, positive brand momentum, public perception, customers, revenue, ability to throw weight in the government… all of these resources you need to succeed as a business. You’re either a snowball rolling down the hill, picking up resources, gaining size and scope and scale, power, credibility as you go... or you’re not – you’re stuck at the top of the hill as a snowflake, and you’re just not going anywhere." "…the question becomes how do you get started? ...to the point where the next resource that you need is more likely to attach to your thing, as opposed to somebody else. That’s the mechanical process that drives the power law. Economists call it preferential attachment.” Startups win when everything in their world starts to preferentially attach to them. That attachment doesn’t always come naturally... when a company is early in its life, or when a person is early in their career, there’s a trust and credibility hurdle that must be overcome. Friends or supporters could help catalyze an attachment by staking some of their reputation and/or capital, for example a young person with no assets trying to buy a house might ask a trusted friend, family or community member to “co-sign” their mortgage. Raising from a top-tier VC is another such “co-sign.” As Marc continues… “…a top VC is a bridge loan of credibility at a point in time where a startup deserves credibility but doesn’t have it yet. This is then harvested in the form of personnel, customers, brand.” More and more, we see that the Series A and/or B round lead (or absence thereof) is the strongest leading indicator of the ultimate outcome. One bet I’m willing to take is that as everything around us becomes “technology” and earlier stage VC continues to institutionalize, this will only become more true. 2- VC has traditionally done “preferential attachment” non-scalably. Venture capital firms win through building personal trust, hands-on partnership between GPs and their founders. GP “value add” comes via their ability to allocate personal time and attention, make introductions into their personal network, maintain a sense of intimacy with the company and context around the challenges it’s trying to overcome. This has always been the job of the VC. Some do it better than others. But intimacy doesn’t scale. Each new investment divides partner attention further. You can add headcount, platform functions, but traditional ‘services’ approaches hit diminishing returns to scale. Moreover, it doesn’t help you with all of the follow-on preferential attachment that has to relentlessly compound in the snowball’s trip down the hill; nearly as much as you’d like. As a result, venture can feel like the opposite of a network-effect business: the bigger the portfolio, the more dilute your attention, and the weaker VC’s incremental value-add on helping any particular snowflake attach to the snowball. 3- It doesn't it need to be that way. For years I’ve been obsessed with this idea of “turning VC into a network effect business.” One of my early career inflection points was joining AngelList in 2014, where I first saw how software could turn networks into infrastructure—removing friction from company formation, capital raising, hiring, and distribution. This became a thread that would weave throughout my subsequent decade and ultimately led to my teaming up with Erik the first time in 2017, himself fresh out of a similar formative experience at Product Hunt. The insight: VC firms need to think like networked product builders, not just service providers. Instead of dividing attention across n+1 companies, you build systems where value compounds... where founders connect to other founders; where operators can access expertise across the portfolio & broader firm's network; where any "ask" becomes a rallying point for those who share an interest in the topic. Every company you back expands that network, every talented individual who joins becomes another n^2 on it's value as a whole. This is what unlocks scalable preferential attachment. A strong brand signals credibility. A large network provides resources. But each on its own is not enough. The combination—a brand that attracts top talent into a network that makes them more successful, creates a compounding loop that helps drive power law outcomes. The result: a shift from diminishing returns to compounding value. Intimacy and direct relationships with GPs remain central. But those GPs now have a very long lever with which to help founders move the world, and can focus their time/attention on the really critical decisions that founders are facing. A16z is one among very few who have managed to cross this chasm—delivering intimacy and exclusivity on the front end (direct relationships between vertical fund GPs and founders), AND network power on the back—operating a platform that institutionalizes access to resources at a scale few yet understand. 4- We are building the F1 pit crew of venture. Big VC is like Formula 1. Hyper-competitive. Big budgets. Media & brand-driven. Top teams need to win hearts and minds, as well as races. GPs are the drivers—instinctive, highly attuned to the conditions on the road, thinking about what lies around the next bend. The greats go on to become household names, and go on generational winning streaks: Lewis Hamilton, Michael Schumacher… Don Valentine, Marc Andreessen. But when Hamilton stands on the F1 podium, it’s easy to miss the work that went on behind the scenes to get him there. Races are won or lost years in advance by teams who design the right chassis, hire the right engineers, drill their pit crews, build cult-like fanbases to keep the sponsor dollars flowing. VC is the same. The GP has to win the deal. It’s easy to glamorize the Partner who get to stand by the founder ringing the NYSE bell. But at the best firms there’s an invisible engine behind them, a “Pit Crew” that must execute immediately and flawlessly, every time. Adrian Newey didn’t win any races — but his arrival as CTO at Red Bull transformed them from a cash-burning midfield team into a generational, world-champion franchise. And the generational VC firms of the next decade won’t just have the best drivers; they’ll also make deliberate, thoughtful investments in the machines they drive. I believe a16z is the most effective preferential attachment machine in the world—but we're going to make it even better. If “marketing” is the top-down vector of storytelling, “ecosystem” is the bottom-up vector of trust. While marketing expands brand and visibility, helps shape the conversation; ecosystem creates the rooms and networks in which those conversations take place. Ecosystem is the hidden operating system of venture. It’s an understanding that today’s senior product manager is tomorrow’s founder; today’s founder becomes tomorrow’s angel investor or advisor. It’s about building the infrastructure to support those 5-10 year journeys as they play out. When the two are in sync, you get the compounding engine that made Silicon Valley what it is: a dense network of people who believe in the same future—willing, and able to build it together. I’m stoked to come back to SF and help make it happen. We’ll be launching new communities, opportunities soon… for now, if you’re exploring—or in the very early stages of starting a new company, drop me a DM or email via dbooth@a16z.com ++ follow @david__booth for more updates, opportunities to get involved. See you soon! 🫡

Saved by Bryan Lord and