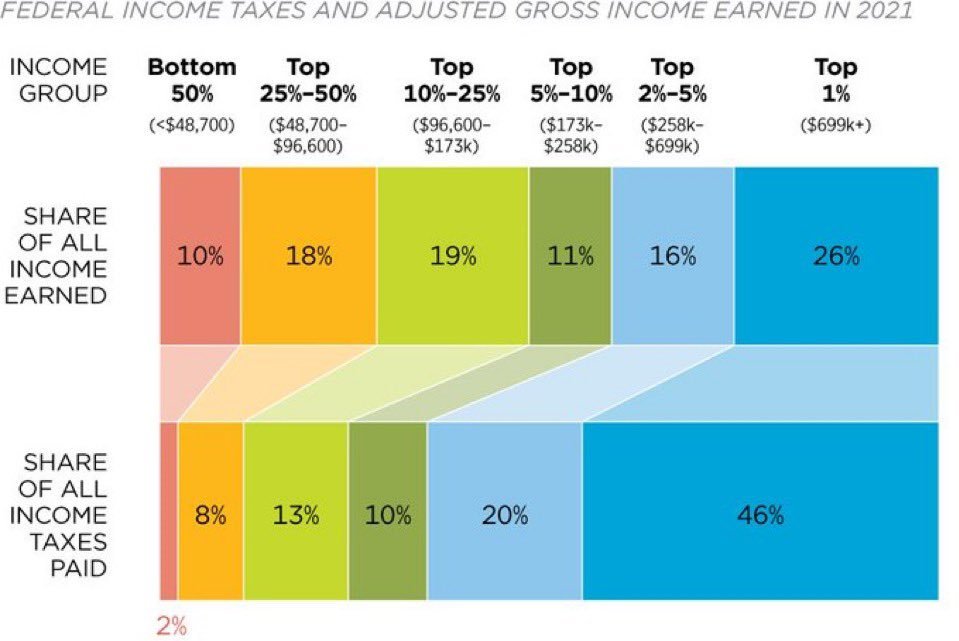

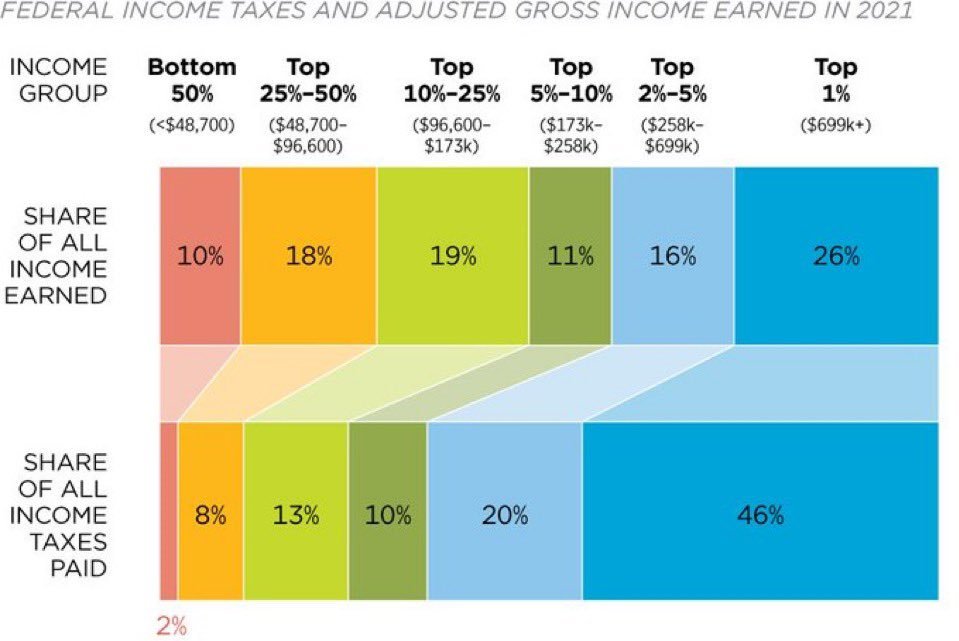

We could suspend all income taxes for people earning less than $100k and the economy would absolutely rip in terms of growth. We would only need to eliminate ~half of the fraud and waste of government spending to balance the resulting budget. But this would shatter the illusion that it's "middle class Americans tax dollars" that fund the state - its not. The middle class funds ~20% of income tax revenues. The vast majority of government services are paid for by the very wealthy, but this is hard to square with a political narrative that wants to seize the wealthy's assets to 'redistribute' it to the poor. But why not just stop taxing the poor and middle class altogether? The state would have us believe it is a better allocator of people's money than themselves, yet this has always been false. The state is a terrible allocator of capital, doesn't get bargains on any of its purchases. A middle class family giving 30-40% of its income to the government when this doesn't move the needle at all in terms of total government budget, but massively influences the quality of living for that family, is a crime by the state against its citizens. Every additional dollar in the hands of that family would directly go to spending and saving, and like I said the economy would rip as a result. More than that, because that family is the best discriminator of value and prices for its own needs, the economy would grow in value *more* than just that dollar amount. The money multiplier effect. Instead, that 30-40% of a middle class family's income goes into government purchasing, where it is siphoned by fraud, waste, abuse, and even when spent, spent extremely poorly. California's budget has doubled in the last ten years while essentially all metrics of public services have declined. Dollars spent wastefully or fraudulently obtained without increasing the value of the economy drive inflation, fundamentally, and erode the net worth of those who have more cash than hard assets - i.e. the working poor and middle classes. If you want to help the working poor and middle class, just abolish all income taxes below $100k, target fraud and waste and financial abuse. This would grow the wealth of the nation far faster than any other means.