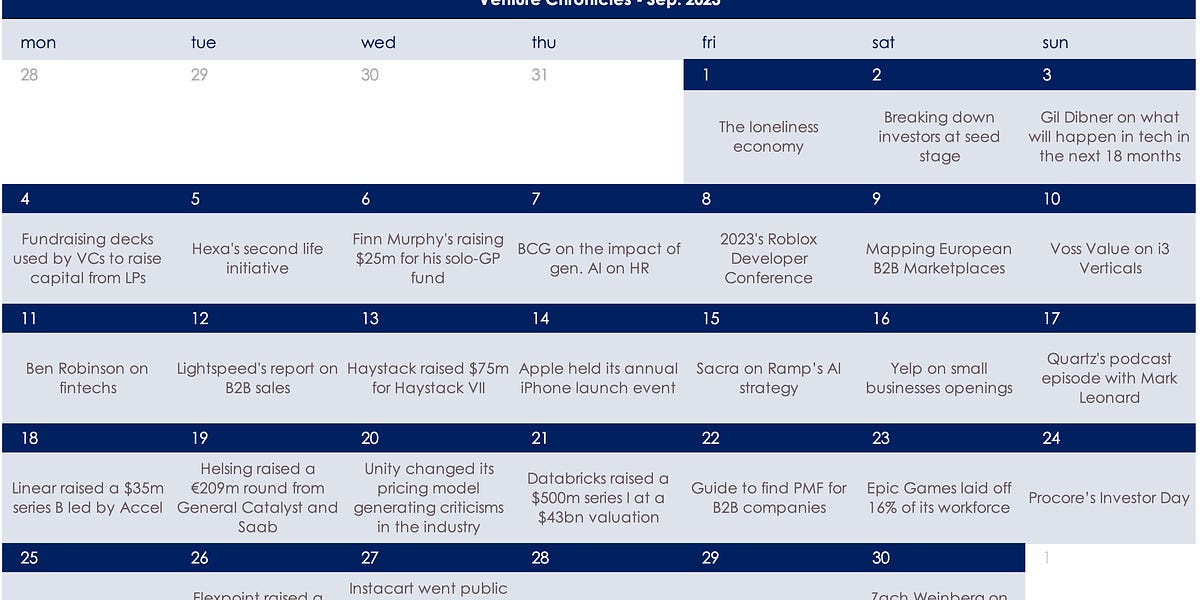

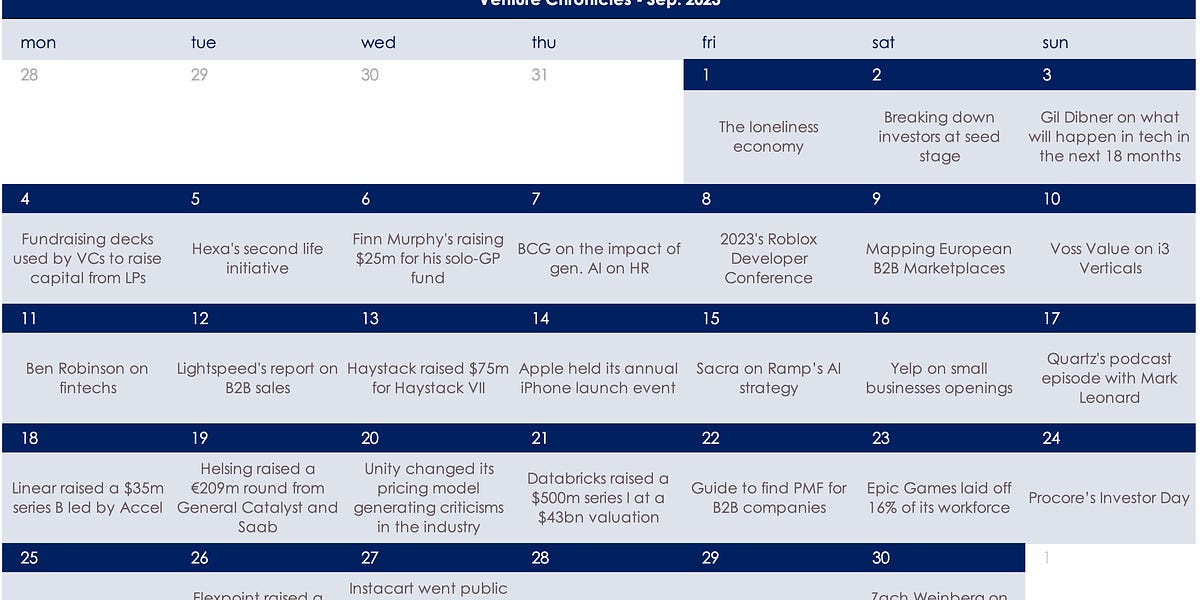

📖 Venture Chronicles - September 2023

Private capital still betting on medtech as VC shifts to late-stage deals

Medtech private investment is increasingly polarized, as record funding for scaled platforms comes at the expense of early-stage innovation, which is struggling to keep pace. Public markets have reemerged as the sector’s main exit engine, with a wave of IPOs offsetting muted... See more

Medtech private investment is increasingly polarized, as record funding for scaled platforms comes at the expense of early-stage innovation, which is struggling to keep pace. Public markets have reemerged as the sector’s main exit engine, with a wave of IPOs offsetting muted... See more

Q3 2025 Medtech VC and PE Trends | PitchBook

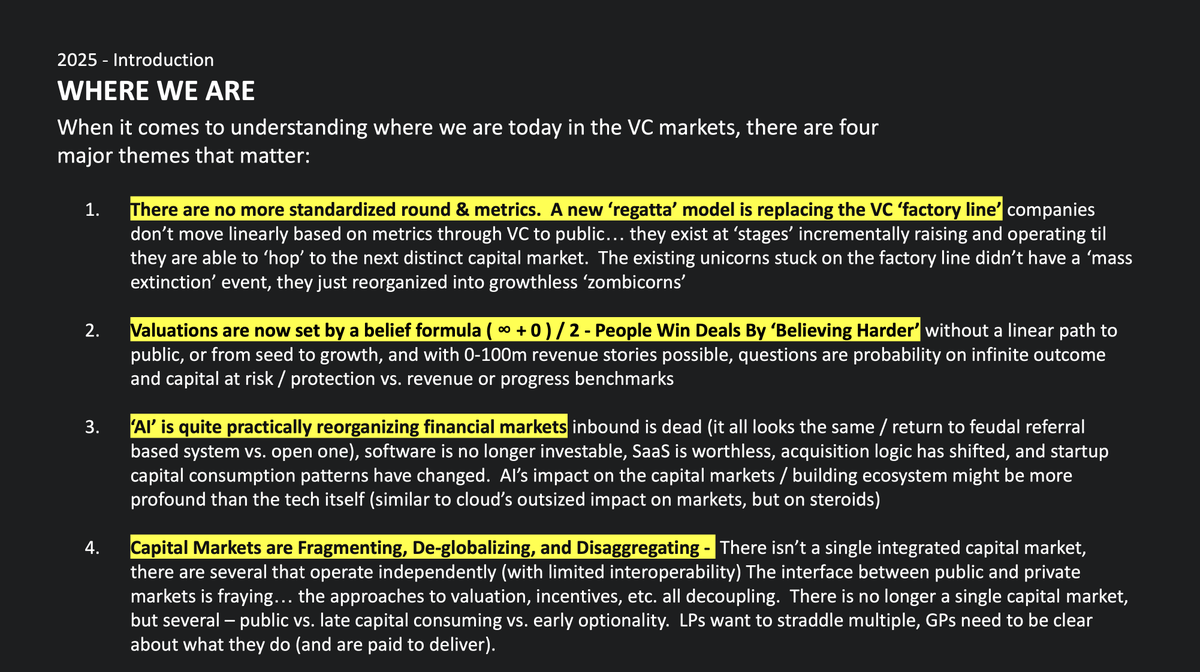

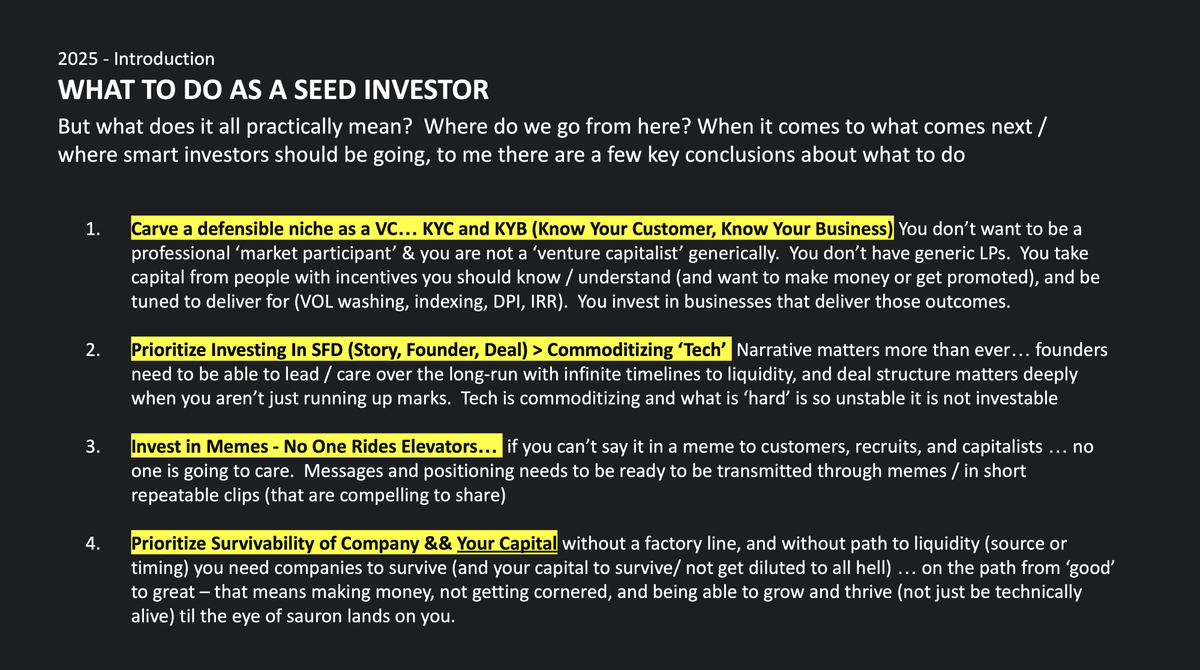

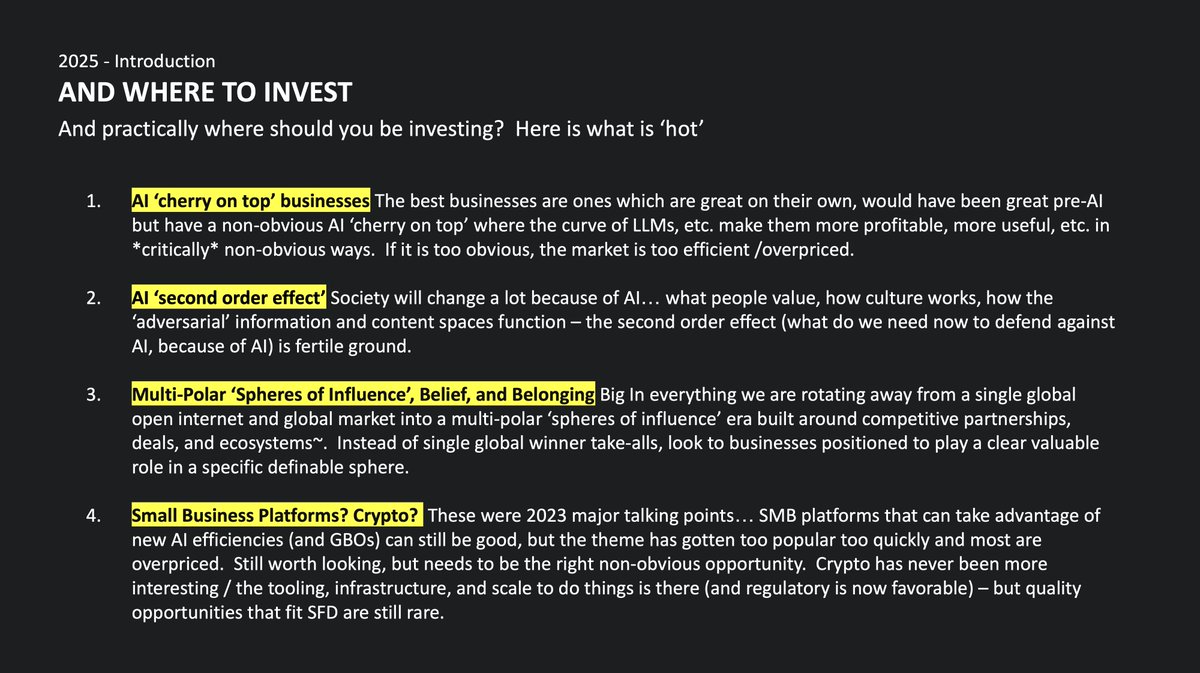

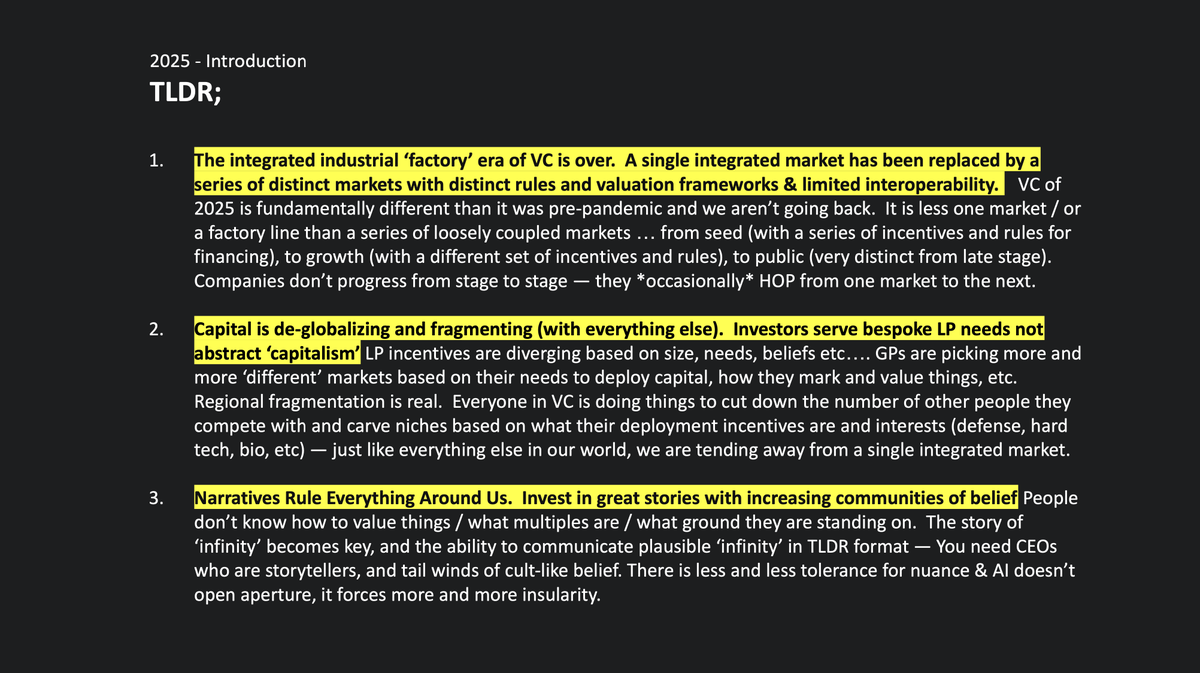

The state of VC in 2025. Where we are, where we are going, and where to invest ... https://t.co/NvOOYzeEpG https://t.co/cbXha8w19L

You can trace the shift cleary through three eras:

- Venture Capitalism (pre-2008)

- Alpha driven by : Risk and discovery.

- Example : Early Google, Genentech, small funds, asymmetric bets.

- Purpose : Generate outsize returns on investment.

- Venture Developmentalism (2008-2020)

- Alpha driven by : Coordination under the state.

- Example : Uber, Airbnb,