Saved by sari and

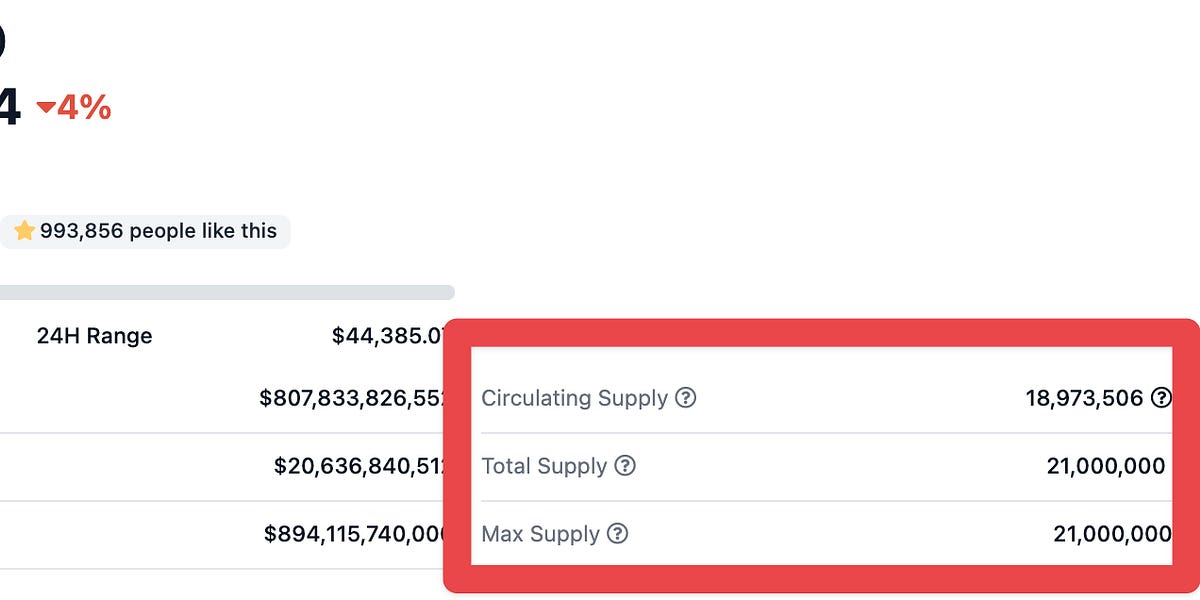

Tokenomics 101: The Basics of Evaluating Cryptocurrencies - DeFriday #19

Saved by sari and

Jonno Evans added

Alex Wittenberg added

Marcel Mairhofer added

Emilie Kormienko added

Marcel Mairhofer added

Marcel Mairhofer added

Alex Wittenberg added

Alex Wittenberg added