The 14 Charts of Christmas

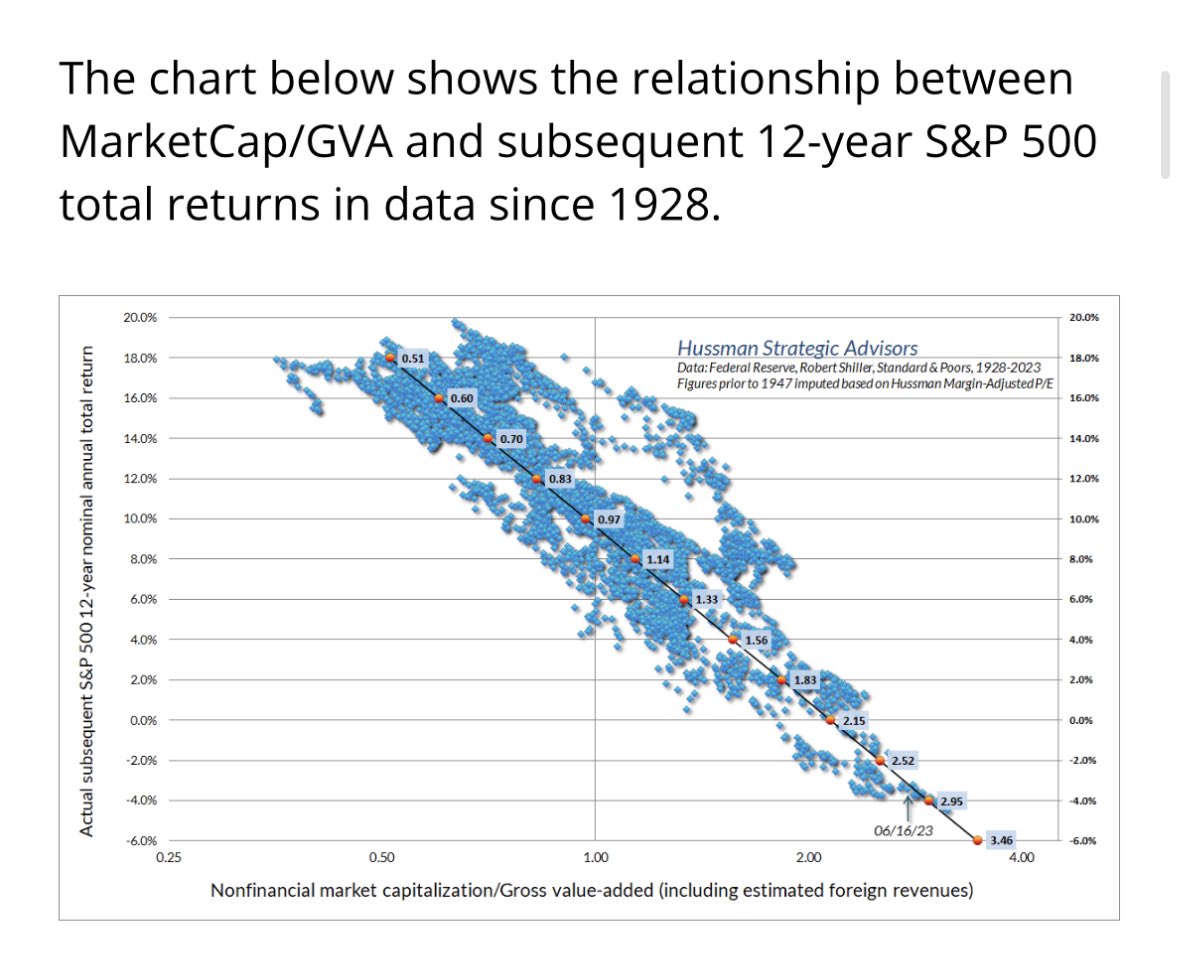

One of the greatest mistakes I see smart people making is assuming that the S&P 500 will yield 8% “because it always has”.

I would to introduce them to Japan’s Nikkei 225. If you bought the index in 1988 (!!!) your return would be negative 25 years later.

Turns out valuation matters.... See more

Gauge 1 – Economic strain: Is investment now large enough to bend the economy?

Gauge 2 – Industry strain: Are industry revenues commensurate with the deployed capex?

Gauge 3 – Revenue growth: Is revenue rising/broadening fast enough to catch up?

Gauge 4 – Valuation heat: How hot are valuations? Compared to history, are stocks excessively overpriced?

Ga

... See more