Stanley Druckenmiller

Stanley Druckenmiller obsesses over position sizing.

And it's one of the (many) reasons why he generated 30% CAGRs without a single down year.

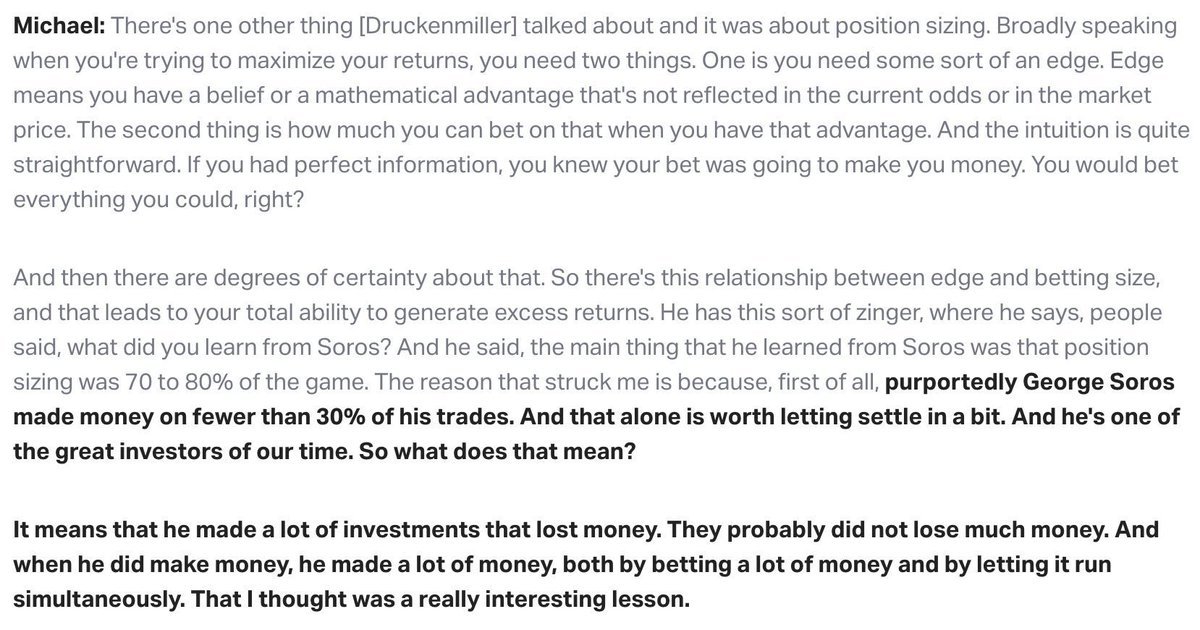

"Position sizing is 70 to 80% of the game."

King of Capital: The Remarkable Rise, Fall, and Rise Again of Steve Schwarzman and Blackstone

amazon.com