Saved by sari

It’s Not Debt, It’s Better: an Interview with Harry Hurst of Pipe

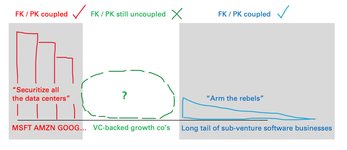

John Street Capital did a deep dive comparing Pipe to the three traditional types of external financing in Recurring Revenue: The Rise of an Asset Class. Based on his assumptions, he found that Pipe was the cheapest cost of capital for a fast-growing, subscription-based business.