Hauser’s Law

“After the 1920s tax cuts, it was not simply that investors’ incomes rose but that this was now taxable income, since the lower tax rates made it profitable for investors to get higher returns by investing outside of tax shelters. The facts are unmistakably plain, for those who bother to check the facts. In 1921, when the tax rate on people making

... See more... See moreMs. Reeves in October unveiled a budget aiming to achieve the highest revenue as a proportion of GDP since World War II.

This exodus has removed those former taxpayers’ capital gains from the tax base, while the higher capital-gains rate probably is discouraging other taxpayers from realizing gains.

News flash: Once a wealthy taxpayer has left the

... See moreAmerica cannot redistribute its way to prosperity. Aggressively raising taxes on the wealthy by 1.5% of GDP ($5 trillion over the decade) and redistributing those funds equally to every American would provide just $1,500 per person annually. Certainly helpful, but no substitute for the rising incomes produced by strong economic growth.

Thus,

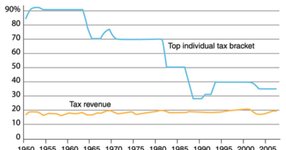

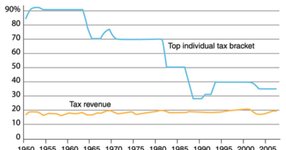

Then everything broke with the doubleheader Depression and war. In 1943 Franklin Roosevelt effectively capped incomes at the equivalent of $400,000 per year, with everything above that taxed at 94 percent. He was reelected in a landslide the next year.

Morgan Housel • Same as Ever: Timeless Lessons on Risk, Opportunity and Living a Good Life

Ich habe nie an Gleichheit geglaubt. Ungleichheit mit gewissen Limits ist der stärkste Motor jeder gesellschaftlichen Entwicklung. Der stärkste Anreiz für Fortschritt besteht nun einmal darin, mehr als die anderen zu haben, mehr Geld, mehr Spaß, mehr Macht. Dass alle Menschen gleich sind, war schon immer eine politische Lüge und wird es immer mehr.

... See more